To quote the last paragraph of this 2008 article by Robert Murphy, when asked why Austrian school economics should be studied, the best answer is: “the Austrian theory of capital is the best one you can find if you really want to grasp how the economy actually works—beyond sterile mathematics and static timeless analysis.” The Austrian school’s understanding of capital and production relies upon three main pillars. First: the factors of production comprise both nature-given factors—namely land and labor—and non-nature-given (i.e., produced by giving up production aimed at immediate consumption) ones—namely capital goods. Second: production in a capitalistic economy requires time and features several stages. Third: the ultimate source of wants satisfaction—and

Topics:

Fabrizio Ferrari considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

To quote the last paragraph of this 2008 article by Robert Murphy, when asked why Austrian school economics should be studied, the best answer is: “the Austrian theory of capital is the best one you can find if you really want to grasp how the economy actually works—beyond sterile mathematics and static timeless analysis.”

The Austrian school’s understanding of capital and production relies upon three main pillars. First: the factors of production comprise both nature-given factors—namely land and labor—and non-nature-given (i.e., produced by giving up production aimed at immediate consumption) ones—namely capital goods. Second: production in a capitalistic economy requires time and features several stages. Third: the ultimate source of wants satisfaction—and hence of subjective value—is consumption, which is the sole ultimate end of production; hence, the farther in time from consumption the output of production is, the less it’s valued—in other words, people have time preferences.

Understanding Production and Time

What is production? It’s human action blending commodities (land) and human energy (labor) in order to attain goods and services conducive to wants satisfaction. If production leads to direct want satisfaction, the outcome of production is consumption goods; otherwise—i.e., if the outcome is delayed want satisfaction, that is, goods and services conducive to satisfaction in future time—the outcome is capital goods.

As Rothbard very effectively describes it, capital is

a way station along the road to the enjoyment of consumers’ goods. He who possesses capital is that much further advanced in time on the road to the desired consumers’ good….Capital goods are “stored-up” labor, land, and time; they are intermediate way stations on the road to the eventual attainment of the consumers’ goods into which they are transformed. (Man, Economy, and State with Power and Market [2009], pp. 52, 58)

Thus, capital is “‘stored-up’ labor, land, and time”—saved resources. The time element is particularly relevant in understanding capital; as a matter of fact, capital can be (also) conceived as previous human beings’ efforts whose outcome—i.e., advancement toward the enjoyment of final consumption—we can now benefit from. In this sense, Böhm-Bawerk’s metaphor is highly illuminating:

The boy who cuts a stick with his knife is, strictly speaking, only continuing the work of the miner who, centuries ago, thrust the first spade into the ground to sink the shaft from which the ore was brought to make the blade. (The Positive Theory of Capital [1891] 1930, p. 88, qtd. in Rothbard 2009, pp. 481–82)

Therefore, insofar as capital is the inheritance of past human action, it’s analogous to giants on whose shoulders today’s producers of consumptive goods are standing: it’s the produced but not yet consumed (and thus transferred into the future) outcome of human action. The metaphors of standing on the shoulders of giants, the knife-ore, and the way station are helpful in understanding another feature of capital: namely capital accumulation as length of production.

In fact, the more capitalistic the economy, the lengthier its structure of production—or, if you will, the taller the giants on whose shoulders the current producers of consumption goods are standing. In other words, even though thinking of a “capitalistic” structure of production as “lengthy” might seem counterintuitive, it nonetheless makes perfect sense. Actually, in order to produce more efficiently (i.e., with a lower input-output ratio) and/or more effectively (i.e., attaining more sophisticated products, such as PCs, smartphones, etc.) today, some human productive action—blending time, labor, and natural resources (land)—needs to have been performed and saved (i.e., not consumed) in the past. In a sense, capital gives producers a head start when compared to the same production occurring without its aid.

Hence, every single capital good is akin to a segment or brick on a road leading to consumption—i.e., satisfaction of wants. The lengthier the structure of production is, the farther the road can go.

Understanding the Role of CapitalGiven that production is ultimately the outcome of blending land, labor and time, we are left with one question: What’s the role of capital? First of all, it should now be clear that if we trace production far back enough, “we must arrive at a point where only labor and nature existed and there were no capital goods” (Rothbard 2009, p. 10). That said, we know that production takes time. A useful way to visualize the interplay of land, labor, and capital in production is the following: since any conceivable consumption good is ultimately an actualization of land and labor’s potential suitability to satisfy human needs, the only obstacle between the original factors (land and labor) and final wants satisfaction (consumption) is time. Imagine you are given an egg. If you want to attain a full-fledged chicken, you will need stored-up grain (i.e., land) to feed the newborn chick and “stored-up” labor to take care of and raise it. Both land and labor are to be taken away from other employments, i.e., saved). You also require the time necessary to bridge the gap between the egg (a potential chicken) and the actual chicken—that is, the final consumption good. So, back to the role of capital: capital allows original factors’ owners to anticipate consumption which would otherwise be accessible only in later time. Thus, capitalists make it possible for laborers and landowners to exchange the future goods they produce—which will ripen only in due time—for present and immediately consumable ones saved (stored) by the capitalists. In other words, capitalists perform a service for the owners of original factors, satisfying and accommodating the latter’s time preferences (i.e., their desire to consume sooner rather than later). As Rothbard phrases it,

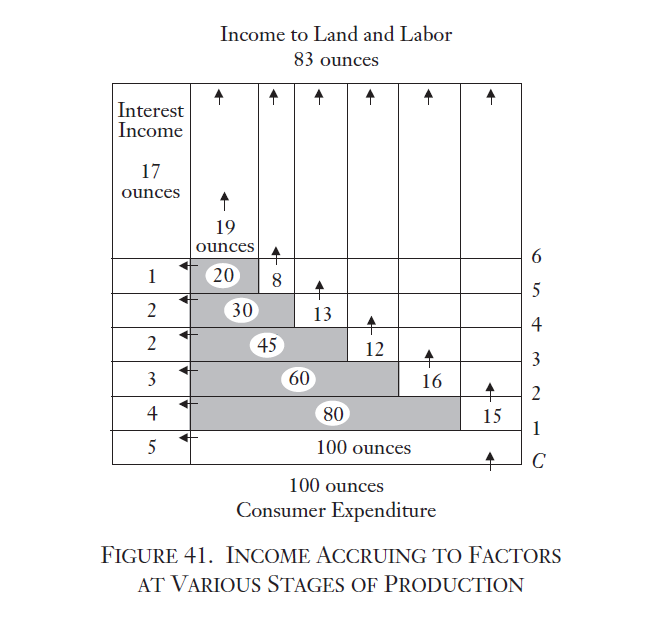

But how does it work in practice? Look at figure 1 (taken from Rothbard 2009, p. 369, figure 41). Consider, for the sake of simplicity, only one stage of production (say, the last one, delivering the consumption goods worth one hundred ounces of gold). |

Income to Land and Labor |

Absent capitalists, the owners of land and labor would need: first, to save enough resources in order to buy the intermediate goods worth 80 ounces of gold from previous-stage producers to work with (but this would be tantamount to becoming capitalists themselves!); second, and more important in practical terms, they would have to wait for the final product to be delivered to consumers, who will pay for it only at the very end of the productive process. Instead, thanks to capitalists, the owners of land and labor get paid—by capitalists—before the final consumption goods are sold in the market, thus enjoying consumption before the end of production.

However, this advanced payment that the owners of original factors enjoy comes at a price—namely the discount rate (or agio). That’s why landowners and laborers, even though the value they added amounts to 20 ounces of gold (100 – 80), will earn only 15 ounces: the difference (5 ounces) is paid to capitalists, who advanced present actual consumable goods (say, money) in exchange for future potential ones.

Conclusion

The concept of capital is intertwined with the idea of time and of saving (storing) scarce resources. Capitalists, acting as intermediaries between present production and future consumption, are the key players in every capitalistic economy: they make it possible for present producers (landowners and laborers) of future potential consumptive goods to enjoy consumption before the actual end of production—thus satisfying the latter’s time preferences.

The price laborers and landowners choose to pay capitalists is the interest (or discount) rate, i.e., the price (or agio) of early consumption. Symmetrically, capitalists are remunerated by landowners and laborers for foregoing consumption today to the advantage of the latter.

Tags: Featured,newsletter