Global Monetary Architecture The quarterly Incrementum Advisory Board meeting was held last week (the full transcript is available for download below). Our regulars Dr. Frank Shostak and Jim Rickards were unable to attend this time, but we were joined by special guest Luke Gromen of research house “Forest for the Trees” (FFTT; readers will find free samples of the FFTT newsletter at the site and in case you want to find the link again later, we have recently added it to our blog roll). Below we add a few remarks on a topic Luke Gromen is paying a great deal of attention to. For readers not familiar with FFTT, Luke has a very special ”big picture” focus, namely the current global monetary architecture and the ways

Topics:

Pater Tenebrarum considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

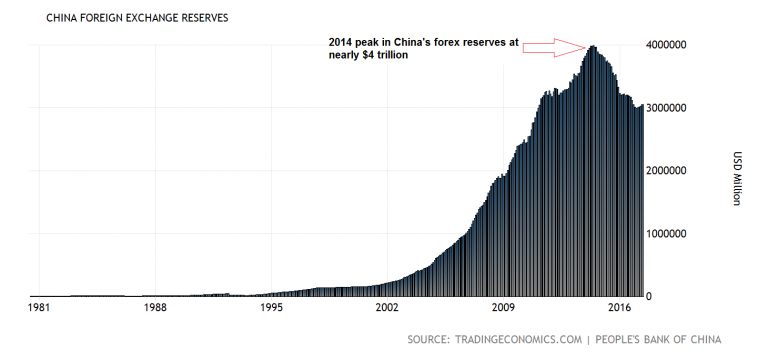

Global Monetary ArchitectureThe quarterly Incrementum Advisory Board meeting was held last week (the full transcript is available for download below). Our regulars Dr. Frank Shostak and Jim Rickards were unable to attend this time, but we were joined by special guest Luke Gromen of research house “Forest for the Trees” (FFTT; readers will find free samples of the FFTT newsletter at the site and in case you want to find the link again later, we have recently added it to our blog roll). Below we add a few remarks on a topic Luke Gromen is paying a great deal of attention to. For readers not familiar with FFTT, Luke has a very special ”big picture” focus, namely the current global monetary architecture and the ways in which it might change. The US dollar has been the world’s senior currency for many decades, but history suggests that this mantle will eventually be passed on. Accumulation of dollar reserves by foreign central banks has soared since the turn of the millennium, and the most conspicuous increase has taken place in China, which has long surpassed former top reserve holder Japan. It is no secret that many foreign governments look askance (and perhaps with a bit of envy) at the “extraordinary privilege”, as Charles de Gaulle once put it, which the dollar’s reserve currency status bestows on the US. Presumably they have all the more reason to do so nowadays. Prior to Nixon’s unilateral suspension of the Bretton Woods gold exchange standard, it could at least be argued that the “privilege” was limited to some extent by the size of US gold reserves. |

|

| In addition to the economic advantage the dollar’s reserve currency status is deemed to convey, there is also a geopolitical dimension to the currency’s role. China and Russia in particular are not entirely happy with the current “unipolar” dispensation – despite the fact that they are largely tolerant of the so-called Pax Americana, and even seem to welcome it to some extent. Still, the governments of both countries clearly want to control their own spheres of geopolitical influence, and often state that they would prefer a “multi-polar” world.

In 2014 the trend in global reserve accumulation began to turn down, as exemplified by China’s reserves in particular (see above). Given that the lion’s share of global trade is invoiced in USD, the governments of countries like China and Russia probably feel as though they are funding their most powerful potential adversary, but they have had little choice in the matter so far – their central banks buy whatever currencies their export sectors earn. Central banks then “recycle” these forex purchases and occasionally diversify them a bit, but then they are faced with the fact that the USD and the US treasury market are the most liquid currency and bond markets in the world, hence diversification opportunities are limited as well. In light of all of the above, it is no surprise that China’s government has made every effort to promote the yuan as a trade and reserve currency. To date the success of these efforts was rather modest though. |

China Foreign Exchange Reserves, 1981 - 2017 |

| Here is though where Luke’s observations come in. The fact that China had only moderate success in establishing the yuan as a trade and reserve currency so far (this includes the symbolic success of the yuan becoming part of the SDR currency basket) doesn’t mean it isn’t continuing to pursue the matter. There are certainly numerous ways in which acceptance of the yuan could be boosted – beyond the effects of bilateral trade settlement agreements China has entered into with a number of nations. An obvious one would be to make the yuan fully convertible, which the government apparently wants to implement very gradually. Anything that involves the government ceding a lot of control is usually handled at a glacial pace.

Luke is currently focusing on a different development though, one that reminds us strongly of an idea forwarded by Dr. Antal Fekete. Fekete essentially argues that one of the pillars on which the post-Bretton Woods fiat money system rests is the fact that there are highly liquid gold markets – both futures and spot gold markets, with the former including the possibility of standardized physical delivery. In Fekete’s words, gold is the “ultimate extinguisher of debt” – and its availability in bullion and gold futures markets allows it to at least function as a “residual extinguisher of debt” these days. Readers may well wonder what that is supposed to mean – after all, Federal Reserve notes are “legal tender for all debts, public and private” – it says so right above the treasury secretary’s signature. Moreover, experience suggests that dollars can certainly be used to discharge debts (the same holds for other fiat currencies in their respective countries of issue). An important wrinkle is also that governments won’t accept anything but the currencies they issue for payment of taxes. These legal stipulations create demand for fiat currency. However, the salient feature of said demand for fiat currency is that it rests primarily on coercion – both legal tender laws and taxation are coercive. Note that not even hyper-rich limousine socialists like Warren Buffett pay a single cent more in taxes than they absolutely have to. Although Mr. Buffett often talks about the alleged need for higher taxes, claiming to be saddened by his own far too low tax bill, we note that his commendable philanthropic endeavors so far do not involve any voluntary donations to the IRS. |

|

| In today’s world, the dollar is money and gold isn’t. Money is the general medium of exchange, the thing that is used as final payment for all other goods and services in the economy. The dollar clearly qualifies under this definition. Nevertheless, gold retains all its essential monetary characteristics; it is so to speak a currency without a passport, a money-in-waiting.

It is the money that originally emerged in the free market and the markets certainly continue to regard it as a monetary asset. The unspoken assumption is that it has the potential to rapidly reemerge as a medium of exchange if/when the current debt-money house of cards falters and joins its predecessors in the hereafter. There was certainly a good reason why it was considered necessary to initially base the post-WW2 monetary system on a gold exchange standard and why the central banks of the largest currency areas continue to hold sizable gold reserves even long after the collapse of the Bretton Woods agreement. Legal stipulations are quite effective, but they are definitely not enough to inspire acceptance of a fiat currency – especially global acceptance as a trade and reserve currency. Dr. Fekete seems to imply that even though there is no longer a gold standard and thus no longer a fixed rate at which government scrip can be redeemed for gold, the fact that one can obtain gold at anytime in fairly sizable amounts in the markets, means that there is at least an escape hatch for dollar holders. Indeed, XAU-USD is the fourth-most liquid currency pair. |

|

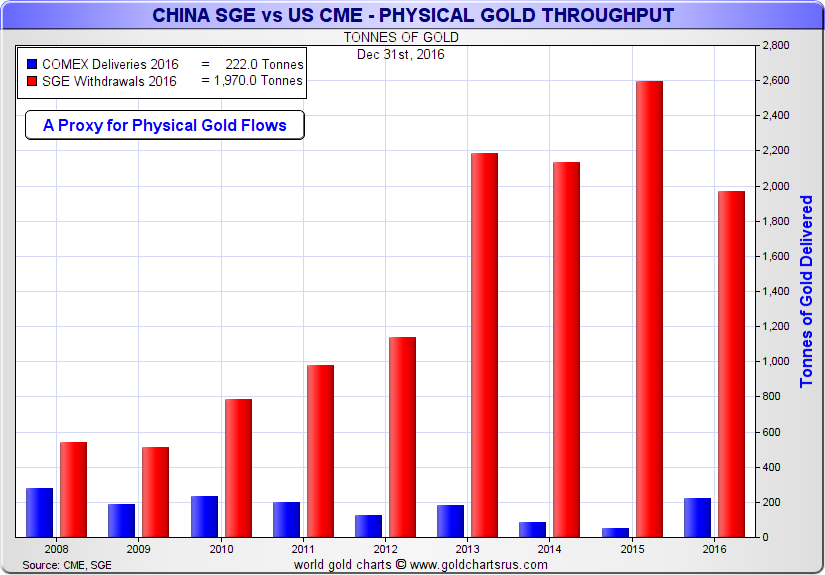

Mandarins Hatching PlansGiven Luke’s focus on the dollar-centric global monetary architecture – which he considers highly vulnerable – he is a keen observer of what is happening in China. China has inter alia established very sizable financial markets, among them one of the world’s largest gold exchanges based in Shanghai (SGE). A particularly noteworthy feature of the SGE are the large amounts of physical gold deliveries effected there. The chart below compares bullion withdrawals from the SGE with CME deliveries. Apparently China’s mandarins plan to open trading on the SGE to foreigners, which we assume would include physical delivery. Readers can probably see where this is going: keeping in mind Dr. Fekete’s “residual debt extinguisher” idea described above, the possibility to purchase yuan-denominated gold contracts and receive physical deliveries of gold for them would presumably have a similar effect on perceptions about the yuan as Western gold markets have with respect to strengthening acceptance of the dollar. Provided gold obtained through the SGE can be easily exported, this would amount to a kind of back-door yuan convertibility, a pseudo Bretton Woods gold cover at freely fluctuating rates. And in keeping with Dr. Fekete’s notion, it would be the mere perception that it can be done that would be the decisive factor, rather than the actual amount of delivery demands. We have pondered whether such deliberations are perhaps a tad too abstract, but we have tentatively concluded that they are not. Consider for instance the euro area’s sovereign debt and banking crisis that culminated in 2011 (for the time being, anyway). Clearly a large number of people weighed the relative merits of the euro currency, European bank deposits and gold precisely in the terms implied by Dr. Fekete’s idea. Gold demand rose strongly as a result and between the summer and early fall of 2011 gold traded at a steep premium. The escape hatch was definitely put to use. |

China SGE vs US CME, 2008 - 2017 |

| Lastly, China’s planners reportedly wish to change China’s economy on a structural level, by slowly moving the economic model away from the high fixed investment, export oriented approach pursued until now toward a more services and consumer focused economy. We suppose it would be easier to implement this plan if acceptance of the yuan as a global trade and reserve currency were to increase significantly. We think they would be quite happy to see the yuan and the dollar trade places; and while we believe that this will still take a very long time, the journey from A to B could get quite interesting. |

Other Topics & Transcript Download

As always, a wide range of topics was discussed at the meeting; we just want to add to this that we will soon expand on the remarks regarding the stock market in these pages. Regular readers already know that we expect the recent sharp decline in US money supply growth to exert a noticeable lagged effect on asset prices and economic activity and we have put together a number of charts and ideas that may prove useful in this context in coming weeks and months.

The transcript of the meeting can be downloaded here: Incrementum Advisory Board Meeting, July 2017 (pdf). Enjoy!

Tags: Featured,newsletter,On Economy