FX The EUR/CHF remained over 1.10 in the last week, thanks to hawkish comments from ECB president Draghi. Headlines Week July 17, 2017 On June 27, Draghi told the audience at the annual ECB Forum that transitory factors were holding back inflation. This has boosted the euro against both USD and CHF. Our opinion, however, is that this “transition” is very long, possibly comparable to the Japanese deflation/ low-inflation over decades. At the latest from December/January 2017/2018, the EUR/CHF must go down again, See the following: Euro/Swiss Franc FX Cross Rate, July 17(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge Why must EUR/CHF go down again? The graph shows that the European

Topics:

George Dorgan considers the following as important: currency reserves. intervention, Featured, monetary data, newslettersent, SNB, SNB sight deposits

This could be interesting, too:

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

FXThe EUR/CHF remained over 1.10 in the last week, thanks to hawkish comments from ECB president Draghi. Headlines Week July 17, 2017

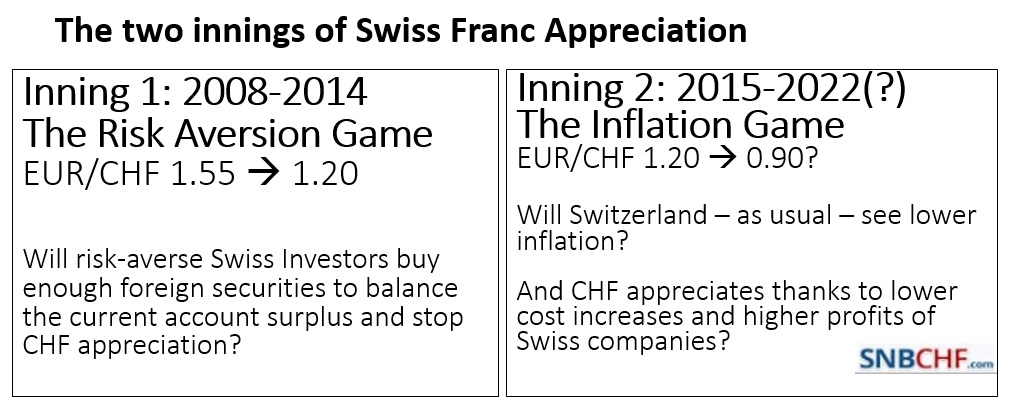

On June 27, Draghi told the audience at the annual ECB Forum that transitory factors were holding back inflation. This has boosted the euro against both USD and CHF. Our opinion, however, is that this “transition” is very long, possibly comparable to the Japanese deflation/ low-inflation over decades. At the latest from December/January 2017/2018, the EUR/CHF must go down again, See the following: |

Euro/Swiss Franc FX Cross Rate, July 17(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge |

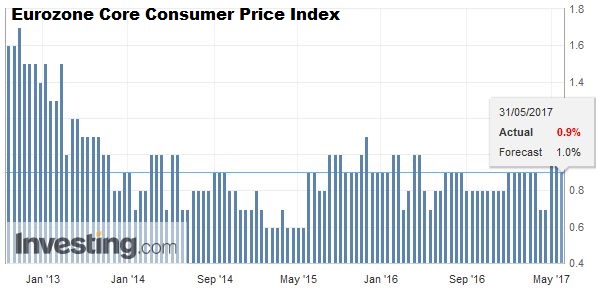

Why must EUR/CHF go down again?The graph shows that the European Core Consumer Price Index has spiked.Many investors also hoping that the ECB will start reducing their bond purchases. Speculators are now long EUR against both USD and CHF. We see core inflation at 1% to 1.3% for the whole year. Headline figure should dive to 1% or lower, once oil price changes are reflected. This should happen in December or early next year. |

Eurozone Core Consumer Price Index (CPI) YoY, May 2017 (flash)(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

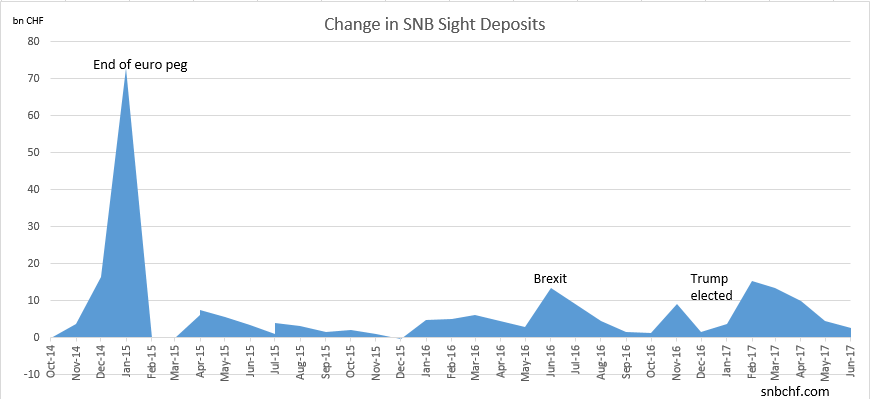

SNB interventions nearly at zeroData for the last weeks: Interventions are near zero: Between 0.1 and 0.4 bn CHF in the last 3 weeks. Background:Swiss private investors do not export their massive trade surplus with purchases assets in foreign currency, apparently because valuations of stock markets are too high and bond rates are too low still. As consequence the SNB intervenes and takes the risk that private investors do not want. With this measure she either risks its bankruptcy or – over the long-term – she deviates from its mandate to avoid inflation. The last time she realized that was in January 2015, when the peg broke. We should remind that the EUR/CHF is clearly higher than the 0.90 that we expect in a couple of years – in the case of a combination of inflation and recession. Intervening at elevated exchange rates – buying euros at 1.08 or dollars at 1.00 – is risky. It obliges the SNB to accumulate owners’ capital – for example with dividends and coupons. Thinking that stock markets will always go up, is an illusion. |

Change in SNB Sight Deposits June 2017(see more posts on SNB sight deposits, ) Source: SNB - Click to enlarge Two Innings of Swiss Franc Appreciation

|

Speculative PositionsSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. Last data as of July 11: The net CHF position has risen from 0.1 short to 0.2 contracts long (against USD). |

Speculative Positions

source Oanda |

| Date of sight deposits (+ link to source) | avg. EUR/CHF during period | avg. EUR/USD during period | Events | Net Speculative CFTC Position CHF against USD | Delta sight deposits if >0 then SNB intervention | Total Sight Deposits | Sight Deposits @SNB from Swiss banks | “Other Sight Deposits” @SNB (other than Swiss banks) |

|---|---|---|---|---|---|---|---|---|

| 14 July | 1.1030 | 1.1429 | +208X125K | +0.2 bn. per week | 578.9 bn. | 482.7 bn. | 96.2 bn. | |

| 07 July | 1.0963 | 1.1377 | -113X125K | +0.1 bn. per week | 578.7 bn. | 486 bn. | 92.7 bn. | |

| 30 June | 1.0913 | 1.1353 | Hawkish Draghi comments | -4669X125K | +0.4 bn.per week | 578.6 bn. | 490.0 bn. | 88.6 bn. |

| 23 June | 1.0857 | 1.1160 | -2982X125K | +0.8 bn. per week | 578.2 bn. | 491.7 bn. | 86.5 bn. | |

| 16 June | 1.0880 | 1.1197 | French parliamentary elections | -14460X125K | +1.0 bn. per week | 577.4 bn. | 482.0 bn. | 95.4 bn. |

| 09 June | 1.0856 | 1.1240 | -16555X125K | +0.3 bn. per week | 576.4 bn. | 476.2 bn. | 100.2 bn. |

For the full background of sight deposits and speculative positions see

SNB Sight Deposits and CHF Speculative Positions

Tags: currency reserves. intervention,Featured,monetary data,newslettersent,SNB sight deposits