“Financial Crisis Of Historic Proportions” Is “Bearing Down On Us” John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major financial crisis, if not later this year, then by the end of 2018 at the latest.” Mauldin is a New York Times bestselling author and respected investment expert and his excellent analysis concludes with advice to prepare urgently for the financial “crisis of historic proportions” which is “once again bearing

Topics:

Mark O'Byrne considers the following as important: Featured, GoldCore, newslettersent, Weekly Market Update

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

“Financial Crisis Of Historic Proportions” Is “Bearing Down On Us”John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major financial crisis, if not later this year, then by the end of 2018 at the latest.” Mauldin is a New York Times bestselling author and respected investment expert and his excellent analysis concludes with advice to prepare urgently for the financial “crisis of historic proportions” which is “once again bearing down on us”: “You and I can’t control whether banks are ready, but we can control whether we are ready. I am working on a number of fronts to help you. My brief time away convinced me beyond any doubt that a crisis of historic proportions is once again bearing down on us. We may have little time to prepare. We definitely have no time to waste.“ His financial crisis warning is important as Mauldin is no perma-bear. Indeed up until now his central thesis was that we were in the “muddle through economy” and that the U.S. economy and global economy would “muddle” along and we would avoid a financial crisis. So not only has he changed his central thesis but he has gone from being neutral and mildly positive to being very bearish and concerned about a severe financial crisis. Mauldin is a long time advocate of owning physical gold including gold coins as financial insurance – taking delivery and secure storage. “I do not think of gold as an investment. It is insurance for me. I buy a fixed amount of gold nearly every month, no matter the price. I hope the price of gold goes down, because that means I get more coins in the mail to go into the vault. Yes, I take delivery of my gold, and it is near me if I need it.” |

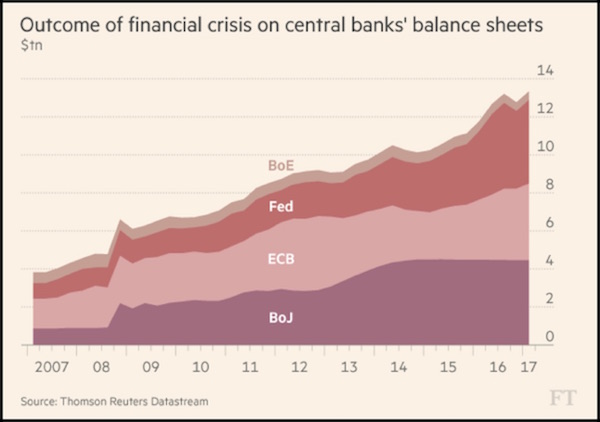

Central Banks Balance Sheets of Financial Crisis, 2007 - 2017(see more posts on Central Bank, ) |

Gold in USDThe way we assess problems depends on our perspective. People can look at the same set of facts and reach quite different conclusions based simply on their circumstances. This is why it’s good at times to get away from your normal environment. Listen to a wide variety of opinions. Read books outside of your comfort zone. You’ll see things differently when you return. I had that feeling on returning to the US from Shane’s and my honeymoon in St. Thomas. We’re now officially married, and we thank everyone for the congratulations and kind wishes. I saw a little bit of news while we were there but spent more time just relaxing with my bride and reading books. Re-entering the news flow was a jolt, and not in a good way. Looking with fresh eyes at the economic numbers and central bankers’ statements convinced me that we will soon be in deep trouble. I now feel that it’s highly likely we will face a major financial crisis, if not later this year, then by the end of 2018 at the latest. Just a few months ago, I thought we could avoid a crisis and muddle through. Now I think we’re past that point. The key decision-makers have (1) done nothing, (2) done the wrong thing, or (3) done the right thing too late. Having realized this, I’m adjusting my research efforts. I believe a major crisis is coming. The questions now are, how severe will it be, and how will we get through it? With the election of President Trump and a Republican Congress, your naïve analyst was hopeful that we would get significant tax reform, in addition to reform of a healthcare system that is simply devastating to so many people and small businesses. I thought maybe we’d see this administration cutting through some bureaucratic red tape quickly. With such reforms in mind I was hopeful we could avoid a recession even if a crisis developed in China or Europe. Six months in, the Republican Congress that promised to repeal and replace Obamacare, cannot even agree on the process. For six years they discussed what to do, and you would think they might at least have a clue … |

Gold in USD, Jan 2008 - 2017(see more posts on Gold, ) |

Tags: Featured,newslettersent,Weekly Market Update