Taking the next few days off. Will be back with week ahead commentary on July 6. Overview: The sharp jump in US long-term interest rates has helped lift the greenback in recent sessions and it remains firm against most of the G10 currencies today. The Canadian dollar is the best performer, and it is nearly flat. The intraday momentum indicators warn that after a mostly consolidative Asia Pacific and European morning, the greenback may probe higher in North...

Read More »Fitch Roils Markets

Overview: Late yesterday, on the eve of the quarterly refunding announcement, Fitch cut the US rating to AA+ from AAA, citing project fiscal deterioration over the next few years and "the erosion of governance". S&P also has the US as an AA+ credit. Ironically, many observers who have been critical of the US monetary and fiscal policies, like former Treasury Secretary Summers and El-Erian, were also critical of Fitch's decision. The US 30-year yield reached its...

Read More »What Happened Today in a Few Bullet Points

The most important thing to appreciate is that the market has moved to price not one but two cuts next year. The first is priced into the September Fed funds futures and the second is in the Dec Fed funds futures. This I in response to weaker than expected data that have elevated recession fears. The Atlanta Fed GDPNow puts Q2 growth at -2.1%. Banks have revised down their forecasts, but none of the 59 economists in the Bloomberg survey have forecast a negative...

Read More »FX Daily, June 11: US Yields Stabilize After Falling to Three-Month Lows

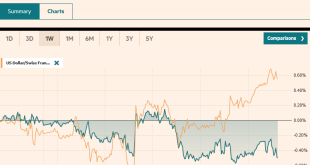

Swiss Franc The Euro has fallen by 0.04% to 1.0879 EUR/CHF and USD/CHF, June 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 10-year US Treasury yield steadied after reaching a three-month low near 1.43%, despite the US CPI rising more than expected to 5% year-over-year. On the week, the decline of around a dozen basis points would be the largest in a year. Australia, New Zealand, and Italy benchmark...

Read More »FX Daily, August 16: Markets Take Collective Breath Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.01% to 1.0841 EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week’s flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to...

Read More »FX Daily, September 08: US Dollar Tracks Yields Lower

Swiss Franc The Euro has fallen by 0.28% to 1.1393 CHF. EUR/CHF and USD/CHF, September 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without...

Read More »Less Than Nothing

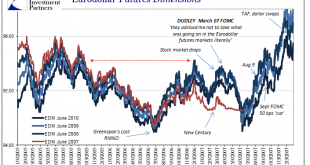

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs. It has been this way from the beginning, even before the beginning as if that was possible. The Great Financial Crisis has no official start date, but we...

Read More »US Jobs: Who Carries The Burden of Proof?

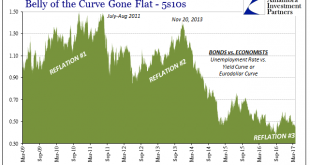

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen. When Mohamed...

Read More »Yen and US Yields

Dollar-yen has been driven by the sharp rise in US bond yields. There are some (dollar) bearish divergences in the JPY/USD technicals. US 10-year yields may also be putting in a near-term top. Since the US election nearly a month ago, the Japanese yen has been the weakest performing major currency. It has fallen 7.5% against the US dollar. At the risk of oversimplifying, there is one major drag on the yen, and that...

Read More »US Political Anxiety Stems Bond Sell-Off

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Bond yields have been rising in the US and Europe since the summer. There are some country-specific considerations and some generalized factors. Anxiety over US politics has helped bonds recover some lost ground. One of the most significant market...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org