Keith gave a keynote address—the only speaker with an hour to cover his topic—at the Gold and Alternative Investments Conference in Sydney on Saturday. Said topic was the nature of money. “Money is a matter of functions four: a medium, a measure, a standard, a store.” Most of the talk was structured around discussing these functions. Medium is pretty obvious: the dollar is the universal medium of exchange. It is basically frictionless, trading at zero spread (with...

Read More »The Elephant in the Gold Room, Report 16 June

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and them bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy! Whether the writer is a bullion dealer, or...

Read More »You Can’t Eat Gold, Report 14 Oct 2018

“You can’t eat gold.” The enemies of gold often unleash this little zinger, as if it dismisses the idea of owning gold and indeed the whole gold standard. It is a fact, you cannot eat gold. However, it dismisses nothing. This gives us an idea. Let’s tie three facts together. One, you can’t eat gold. Two, gold is in backwardation in Switzerland. And three, speculation is a bet on the price action. The fact that gold is...

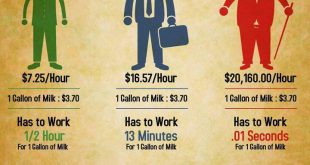

Read More »Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language). So it is with wry amusement that, this week, Keith heard an ad for an...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org