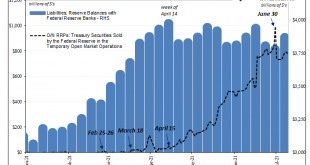

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big. To end Q2 2021, financial counterparties “lent” just about $1 trillion to the Fed. Holy cow! A trillion! There’s way too much money! Eh. The RRP, especially around its more informative margins, has little to do...

Read More »ISM Spoils The Bond Rout!!! Again

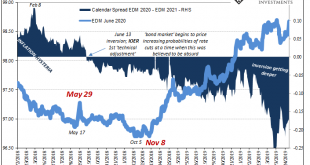

For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers. Bid-to-cover, however, is irrelevant. That only tells you about one part of the buying equation, the number...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org