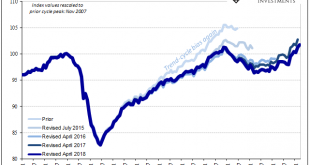

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

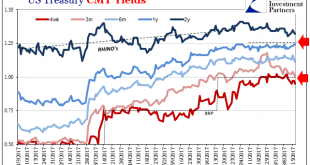

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day. A lot has happened between now and then, including three additional “rate hikes” dating back to December 2016, the last in June 2017. The yield...

Read More »Mugged By Reality; Many Still Yet To Be

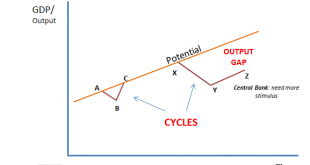

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them. At Janet...

Read More »The Fed Raised Rates: Now What?

Enough talk already. The moment is finally here: The Federal Reserve raised interest rates today by 0.25 percent for the first time since June 2006. Credit Suisse doesn’t believe the small, well-anticipated hike will hurt the U.S. economy in and of itself. (What happens in rate-sensitive markets, especially high-yield bonds, is another story, and one that The Financialist will cover in the coming days.) More important to financial markets are the signals Federal Reserve Chair Janet Yellen...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org