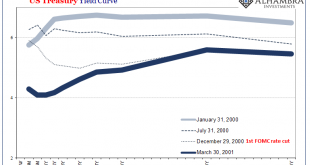

Even though it was a stunning turn of events, the move was widely celebrated. The Federal Reserve’s Open Market Committee, the FOMC, hadn’t been scheduled to meet until the end of that month. And yet, Alan Greenspan didn’t want to wait. The “maestro”, still at the height of his reputation, was being pressured to live up to it. The Fed had begun to cut rates. In Austin, Texas, where President-elect Bush and many prominent business leaders were gathered, the news...

Read More »The Inventory Context For Rate Cuts and Their Real Nature/Purpose

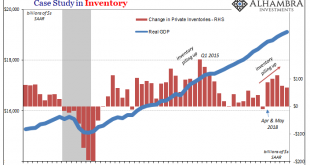

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process. An economy for whatever reasons slows down. That leads to inventory piling up across the various levels of the supply chain....

Read More »Three (Rate Cuts) And GDP, Where (How) Does It End?

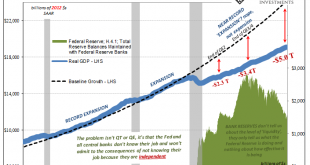

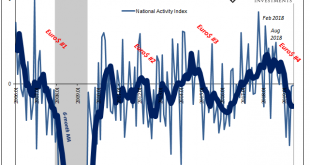

The Federal Reserve has indicated that it will now pause – for a second time, supposedly. Remember the first: after raising its benchmark rates apparatus in December while still talking about an inflationary growth acceleration requiring even more hikes throughout 2019, in a matter of weeks that was transformed into a temporary suspension of them. Expecting the easy disappearance of “transitory” factors, that Fed pause was to be followed by the second half rebound...

Read More »The Inventory Context For Rate Cuts And Their Real Nature/Purpose

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process. An economy for whatever reasons slows down. That leads to inventory piling up across the various levels of the supply chain....

Read More »Macro Housing: Bargains and Discounts Appear

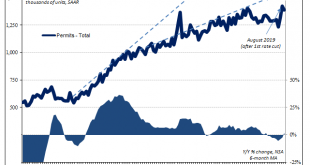

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space. Homebuilders, at least, responded in August 2019 to the first rate cut in a decade exactly the way the FOMC had imagined when...

Read More »From JOLTS Series Shift To Series of Rate Cuts

I’ve said all along that they would be dragged into them kicking and screaming. After all, the Federal Reserve undertook its last rate hike in December 2018 – just as the markets were making clear he was completely mistaken in his view of the economy. What followed was the ridiculous “Fed pause” which pretty much everyone outside of the central bank and the Economics profession knew wasn’t the end of it. You know the story. When he finally gave in at the end of July,...

Read More »Waiting on the Calvary

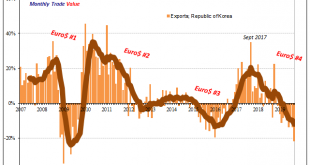

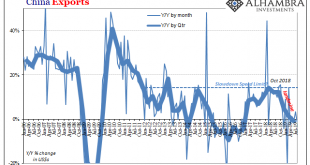

Engaged in one of those protectionist trade spats people have been talking about, the flow of goods between South Korea and Japan has been choked off. The specific national reasons for the dispute are immaterial. As trade falls off everywhere, countries are increasingly looking to protect their own. Nothing new, this is a feature of when prolonged stagnation turns to outright contraction. While the dispute with Japan hasn’t helped, it isn’t responsible for the level...

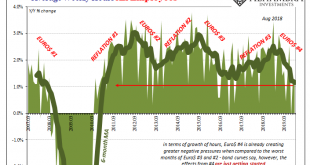

Read More »Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009. And there’s more to come. As Bloomberg reported late last week: Over the next 12 months, interest-rate swap markets have priced in around 58 more...

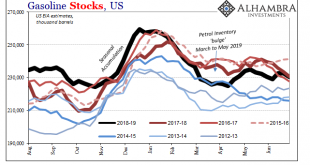

Read More »The Path Clear For More Rate Cuts, If You Like That Sort of Thing

If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months. That wasn’t all, as the EIA’s report focused in on some more sobering aspects...

Read More »US Economic Crosscurrents Reach the 50 Mark

In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat. A few billion in tariffs, even if we include what is to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org