Cryptic Pronouncements If a world conflagration, God forbid, should break out during the Trump Administration, its genesis will not be too hard to discover: the thin-skinned, immature, shallow, doofus who currently resides in the Oval Office! The commander-in-chief – a potential source of radiation? - Click to enlarge This past week, the Donald has continued his bellicose talk with both veiled and explicit threats...

Read More »India: The Genie of Lawlessness is out of the Bottle

Recapitulation (Part XVI, the Last) Since the announcement of demonetization of Indian currency on 8th November 2016, I have written a large number of articles. The issue is not so much that the Indian Prime Minister, Narendra Modi, is a tyrant and extremely simplistic in his thinking (which he is), or that demonetization and the new sales tax system were horribly ill-conceived (which they were). Time erases all...

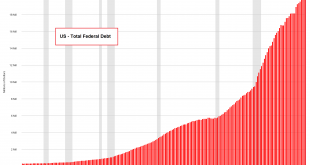

Read More »US Debt: To Hell In A Bucket

No-one Cares… “No one really cares about the U.S. federal debt,” remarked a colleague and Economic Prism reader earlier in the week. “You keep writing about it as if anyone gives a lick.” We could tell he was just warming up. So, we settled back into our chair and made ourselves comfortable. “The voters certainly don’t care about the federal debt,” he continued. “They keep electing the same spendthrifts to office. And...

Read More »The Government Debt Paradox: Pick Your Poison

Lasting Debt “Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted. The Obama administration...

Read More »Why There Will Be No 11th Hour Debt Ceiling Deal

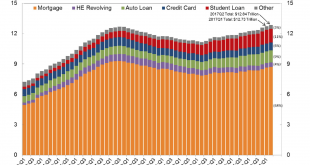

Milestones in the Pursuit of Insolvency A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a report published on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago. United States Consumer DebtUS consumer...

Read More »What Went Wrong With the 21st Century?

Fools and Rascals And it’s time, time, time And it’s time, time, time It’s time, time, time that you love And it’s time, time, time… – Tom Waits [embedded content] Tom Waits rasps about time POITOU, FRANCE – “So how much did you make last night?” “We made about $15,000,” came the reply from our eldest son, a keen cryptocurrency investor. “Bitcoin briefly pierced the $3,500 mark – an all-time high. The market cap of...

Read More »The Myth of India’s Information Technology Industry

A Shift in Perception – Indians in Silicon Valley When I was studying in the UK in early 90s, I was often asked about cows, elephants and snake-charmers on the roads in India. A shift in public perception— not in the associated reality — was however starting to happen. India would soon become known for its vibran As more IT graduates from India moved to the US to work, they lobbied to change how India was viewed,...

Read More »Congress’s Radical Plan to End Illegal Money

What Constitution? One of the many downfalls of being the United States Secretary of the Treasury is the requirement to place one’s autograph on the face of the Federal Reserve’s legal tender notes. There, on public display, is an overt record of a critical defect. A signature endorsement of a Federal Reserve note by the Treasury Secretary represents their personal ratification of unconstitutional money. If you...

Read More »India: The Lunatics Have Taken Over the Asylum

Goods and Services Tax, and Gold (Part XV) Below is a scene from anti-GST protests by traders in the Indian city of Surat. On 1st July 2017, India changed the way it imposes indirect taxes. As a result, there has been massive chaos around the country. Many businesses are closed for they don’t know what taxes apply to them, or how to do the paperwork. Factories are shut, and businesses are protesting. [embedded...

Read More »Jayant Bhandari on Gold, Submerging Markets and Arbitrage

Maurice Jackson Interviews Jayant Bhandari We are happy to present another interview conducted by Maurice Jackson of Proven and Probable with our friend and frequent contributor Jayant Bhandari, a specialist on gold mining investment, the world’s most outspoken emerging market contrarian, host of the highly regarded annual Capitalism and Morality conference in London and consultant to institutional investors. As soon...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org