Das Risiko steigt mit den Schulden: Behelfmässig geschlossene Bancomaten der Barclays Bank in London. Foto: Chris Helgren (Reuters) In diesen Frühlingstagen vor sieben Jahren informierte die griechische Regierung ihre EU-Partner und Brüssel, dass sie ohne finanzielle Unterstützung nicht in der Lage sei, ihren finanziellen Verpflichtungen nachzukommen. Es war der Anfang der Euro-Staatsschuldenkrise. Heute leben wir zwar mit der Gewissheit, dass die unmittelbaren Risiken des unvorstellbar...

Read More »These Are The 3 Main Issues For Europe In 2017

Submitted by George Friedman and Jacob Shapiro via MauldinEconomics.com, What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake....

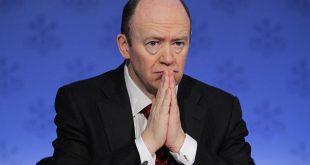

Read More »Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach ‘Deal’ With DOJ: Bild

Following the seemingly endless procession of short-squeeze-fueling trial balloons last week – from settlement rumors to German blue-chip bailouts to Qatari investors – Germany’s Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department. John Cryan - Click to enlarge Having soared over 25% off the briefly...

Read More »Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »European Banks and Europe’s Never-Ending Crisis

Landfall of a “Told You So” Moment… Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored. This actually worked for a...

Read More »The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers. First, the measures implemented since 2009 created an artificial stability and an asset price boom in many markets. But the absolute rate of GDP expansion and level of price changes is inadequate to solve global debt problems. Second, new initiatives seem the risky response of clever...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org