Keystone / Sebastian Gollnow An appeal court in Paris has confirmed that Swiss bank UBS is guilty of having assisted French tax evaders – but reduced the penalty from €4.5 billion (CHF4.7 billion) to €1.8 billion. Switzerland’s largest bank systematically helped French clients evade taxes between 2004 and 2012 by enticing them to hide their money in Switzerland, the appeal court said on Monday. In 2019, UBS was originally fined €3.7 billion and ordered to pay...

Read More »More Swiss firms facing cyber-attacks and ransom demands

An attractive target: a Swiss server. © Keystone / Christian Beutler Ransomware attacks by hackers continue to increase sharply, with some 2,700 Swiss firms falling victim over the past year, Beobachter magazine has reported. The figure for the period August 2020 to August 2021 was arrived at by American cybersecurity firm Recorded Future, Beobachter wrote on Wednesday. Measured against the 4,800 attacks over the past five years as a whole, this means a big uptick,...

Read More »‘Pandora Papers’ shed more light on activities of Swiss financial advisors

Tax havens link up with a network of financial advisors and banks in numerous countries to funnel assets around the world. Copyright 2019 The Associated Press. All Rights Reserved. A new set of leaked documents, dubbed the Pandora Papers, has again exposed the role of Swiss lawyers, accountants and consultants in managing the wealth of powerful clients. The International Consortium of Investigative Journalists (ICIJ) has revealed the contents of 11.9 million tax...

Read More »US charges Swiss finance firm and six people with tax evasion

The US still suspects some elements of the Swiss financial centre of helping tax evaders. © Keystone / Ti-press / Alessandro Crinari Six people and a Swiss financial services firm have been charged in the United States with helping clients evade taxes on $60 million (CHF56 million) of assets. They are accused of setting up an elaborate scheme, known as the “Singapore Solution”, to funnel money out of Switzerland, through structures in Hong Kong and Singapore, and...

Read More »Corruption trackers flag increased global money laundering risks

Keystone / Mast Irham The global community is slipping in its efforts to tackle money laundering and terrorist finance, a Swiss corruption watchdog warned on Monday. The Basel Institute on Governance said the global risk score increased from 5.22 to 5.3 out of 10 (highest risk score) in its Anti-Money Laundering Index. In 2021, Switzerland scored 4.89 in the independent annual ranking that examines the risk of money laundering in 110 jurisdictions. That marks an...

Read More »Ex-roads ministry worker ‘paid CHF2,000 a month’ to rig emissions data

Switzerland has introduced targets and regulations to reduce vehicle C02 emissions. © Keystone / Gaetan Bally A former employee at the Swiss Federal Roads Office (FEDRO) and two board members of a vehicle exporter have been charged with fraudulently manipulating data to avoid CO2 emissions sanctions. The Swiss federal prosecutor’s office said on Monday that the fraud had illegally saved the vehicle exporter from paying CHF9 million ($9.8 million) in financial...

Read More »How vaccine passports may make Swiss e-ID rejection obsolete

UN economist Ian Richards argues that Swiss voters’ fears of a proposal for an e-ID may be swept away as more countries see the benefits of digitising documents, including vaccine passports. A week ago the Swiss public voted overwhelmingly to reject a digital identity scheme that would have given each Swiss citizen and resident an official login and password to open bank accounts, vote, or buy train tickets and ski passes online. The login would be certified,...

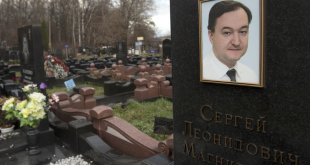

Read More »Bill Browder threatens legal action over Swiss bank accounts linked to Magnitsky scandal

The Hermitage fraud became an international cause célèbre after the death in custody of Browder’s lawyer, Sergei Magnitsky. Keystone High-profile Kremlin critic and investor Bill Browder has threatened Credit Suisse and UBS with legal action for breaching US sanctions if they unfreeze accounts belonging to three Russian clients accused of a huge tax fraud against his investment company. The two Swiss banks hold assets worth more than $24 million (CHF21.8 million),...

Read More »Switzerland and UK balance sovereignty with EU market access

Britain’s controversial Internal Market Bill has prompted Switzerland’s former chief negotiator with the EU, Michael Ambühl, to examine the thorny issue of sovereignty in EU talks. The issue of balancing access to the EU market in exchange for a degree of EU regulatory intrusion on home turf has come to the fore during the ongoing Brexit negotiations. The British government is trying to enact new legislation, the Internal Market Bill, that could limit the ability of...

Read More »Doubts over EU regulations deal raise prospect of higher City costs

London’s financial district. Britain and the EU are negotiating financial regulation post-Brexit, with Switzerland caught in the middle. Keystone / Hannah Mckay On a Monday morning, just over a year ago, investment firms across the EU found they were no longer allowed to trade on the Swiss stock exchange. It happened almost overnight — simply because Brussels refused to extend a regulatory “equivalence” deal with Switzerland, which gave each side free access to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org