The value of cryptocurrencies like bitcoin, just like any other kind of money, comes fundamentally from what you can do with it. As a follow up to What Backs Bitcoin, I want to dig into that value. The idea, which comes from Austrian economist Carl Menger, is that just as a shovel’s value comes from its ability to dig, a currency’s value comes from its ability to help you do two things: transactions and savings. Think...

Read More »Bitcoin Tops $10,100 – Fed’s Powell Says “Cryptocurrencies Just Don’t Matter”

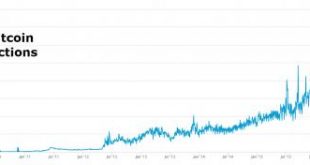

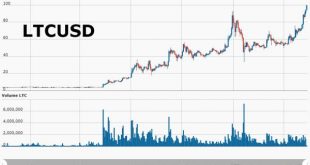

Update: Cryptocurrencies are widely bid tonight with Bitcoin over $10,150, Ether holding $475, and LiteCoin topping $100 for the first time… LiteCoin Price in USD, Mar - Nov 2017(see more posts on Litecoin, ) - Click to enlarge Bitcoin has now soared over 20% since Black Friday’s close, topping $10,000 for the first time in history (rising from $9,000 in just 2 days)… now up over 950% year-to-date. image courtesy...

Read More »The World’s Largest ICO Is Imploding After Just 3 Months

Earlier this summer, Tezos smashed existing sales records in the white-hot IPO market after the company’s pitch to build a better blockchain for cryptocurrencies made it one of the buzziest ICOs in the world. As we noted at the time, the company capitalized on that buzz by courting VC firms and other institutional investors with a $50 million token pre-sale. After the company opened up selling to the broader public,...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one 'entity' has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since mid-July, as the Financial Times noted in a story about its...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

Read More »BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the “VIX is now broken.” Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the “central banks’ central bank”...

Read More »The Swiss Begin To Hoard Cash

While subtle, the general public loss of faith in central banking has been obvious to anyone who has simply kept their eyes open: it started in Japan where in February hardware stores were reported that consumers were hoarding cash, as confirmed by the spike in demand for safes, “a place where the interest rate on cash is always zero, no matter what the central bank does.” Then, as we reported just over a week ago,...

Read More »Jan Skoyles Appointed Research Executive At GoldCore

(Media Release - September 8, 2016 - Immediate Release) – Jan Skoyles - @Skoylesy has been appointed Research Executive at international gold specialist @GoldCore . As a recognized thought leader in the gold and fintech space, Jan will augment GoldCore’s research capabilities and will focus on the UK economy and gold’s role as an important diversification, payment and savings vehicle. As one of the world's largest and fastest growing gold bullion delivery...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org