It has never been more important to own gold as part of a diversified portfolio. The form your gold investment takes is just as important as owning it in the first place. ETFs and pooled gold may not be functional in extreme markets and may themselves be subject to systemic risk events. Fifty gram gold bars sit across a one kilo gold bar at bullion dealers Goldcore, in London, U.K., on Thursday, March 11, 2010. Photographer: Chris Ratcliffe/Bloomberg We are living in extraordinary times...

Read More »Will The ECB Buy Stocks?

Authored by Nick Kounis and Kim Liu via ABN AMRO, Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility We think the ECB could legally buy ETFs that fit its requirements… … but it would be controversial and we question the benefits An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme …and assuming a...

Read More »Confiscation: Sorry, You Can’t Have Your Gold

Submitted by Jeff Thomas via InternationalMan.com, We warn regularly of the risk involved in storing wealth in banks. They’ve made the removal of your deposits increasingly difficult in addition to colluding with governments to allow them to legally freeze or confiscate your money. To add insult to injury, they’re creating reporting requirements with regard to the contents of safe deposit boxes and restricting what...

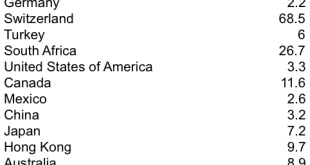

Read More »Best Countries To Store Gold: How Did America, A Serial Defaulter, Make The Cut?

[unable to retrieve full-text content]An era of slowing growth, falling corporate profits, record debt levels, and currency debauchment has many investors buying gold as a bet against global central banks. Holding that gold outside the banking system, and for some, outside one’s own country, are increasingly popular options. Canada, Switzerland, and four other countries have particularly attractive characteristics.

Read More »Jan Skoyles Appointed Research Executive At GoldCore

(Media Release - September 8, 2016 - Immediate Release) – Jan Skoyles - @Skoylesy has been appointed Research Executive at international gold specialist @GoldCore . As a recognized thought leader in the gold and fintech space, Jan will augment GoldCore’s research capabilities and will focus on the UK economy and gold’s role as an important diversification, payment and savings vehicle. As one of the world's largest and fastest growing gold bullion delivery...

Read More »FX Daily, August 19: Dollar Recovers into the Weekend

Swiss Franc: In the real effective exchange rate calculation, the PPI plays an important role. The Swiss producer price index fell by 0.8% YoY, while the German one is down 2.0%. Thismeans that in 2016 the CHF overvaluation is rising, when compared to the major Swiss trading partner Germany. The values for 2015 were -6% for the Swiss and -2.5% for Germany, the CHF overvaluation was reduced. Click to enlarge. Source...

Read More »The World’s Dominant Gold Refineries

There are many precious metals refineries throughout the world, some local to their domestic markets, and some international, even global in scale. Many but by no means all of these refineries are on the Good Delivery Lists of gold and/or silver. These lists are maintained by the London Bullion Market Association (LBMA) and they identify accredited refineries of large (wholesale) gold and silver bars that continue to...

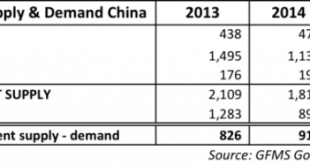

Read More »Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

Read More »Yuan and Why

(I write a monthly column for a Chinese paper. Here is a draft of it) It is as if Hamlet, the confused prince of Denmark, has taken up residence in Beijing. The famed-prince wrestled with “seeming” and “being”. So are Chinese officials. They seem to be relaxing their control over financial markets but are they really? Are they tolerating market forces because they approve what they are doing, such as driving interest...

Read More »UK Imported Net 152 Tonnes of Gold in June, 68 from Switzerland

On a firmly rising gold price the UK is one of the largest net importers of gold in 2016. The gold price went up 25 % from $1,061.5 dollars per troy ounce on January 1 to $1,325.8 on June 31. Over this period the UK net imported 583 tonnes and GLD inventory mushroomed by 308 tonnes. In the month of June the UK gross imported 154.2 tonnes, up 22 % from May, and gross export was 1.9 tonnes, down 37 % from the previous...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org