Swiss Franc EUR/CHF - Euro Swiss Franc, January 11 (see more posts on EUR/CHF, ) - Click to enlarge The pound has seen a sharp fall following the interview that Theresa May gave with Sky news on Sunday although there has been a small rebound this afternoon. GBP CHF exchange rates are hovering around 1.2350 for this pair. The pound fell sharply in morning trade but has since recovered as there still remains a...

Read More »FX Daily, January 10: Positioning more than Fundamentals Give Traders Pause

Swiss Franc EUR/CHF - Euro Swiss Franc, January 10(see more posts on EUR/CHF, ) - Click to enlarge Sterling is on the ropes following Brexit comments made by UK Prime Minister Theresa May over the weekend. It’s been a tough day’s trading for any clients holding the Pound with losses against all of the major currencies. GBP/CHF rates have dropped by a cent and a half with the pair now trading in the mid 1.23’s,...

Read More »FX Daily, January 09: Sterling Pounded by May’s Hard Brexit

Swiss Franc EUR/CHF - Euro Swiss Franc, January 09(see more posts on EUR/CHF, ) - Click to enlarge I am reading a lot about the pound in 2017 which is likely to be as volatile as in 2016. But the Franc is a harder beast to predict. Loosely tracking the euro but subject to its own rules and trends GBPCHF could be an interesting pair to watch in 2017. There are numerous global events which can shape the...

Read More »FX Weekly Preview: Macro Forces Underpin Dollar, Equities and Yields

Summary: Odds of a March Fed hike edged up last week, and Q4 GDP figures were revised higher. Many continue to expect the new US Administration to pursue pro-growth tax reform, deregulation and infrastructure spending. Although many other high income countries are growing, near trend divergence of monetary policy continues. United States The major US equity indices reached record highs before the weekend even...

Read More »US Jobs Details Better than the Headline

United States The dollar and US yields are recouping more of yesterday’s decline. A break of $1.0480-$1.05 would suggest the euro’s upside bounce is exhausted. A dollar move above JPY116.80-JPY117.25 would also hint that the greenback was going to make an other run toward JPY118.30-JPY118.60. Sterling support is seen in the $1.2285-$1.2310 area. The Canadian dollar is struggle to sustain it upward momentum. A US dollar...

Read More »FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

Swiss Franc EUR/CHF - Euro Swiss Franc, January 05(see more posts on EUR/CHF, ) - Click to enlarge The Swiss Franc has limited data releases to note for the upcoming weeks therefore I expect news from the Brexit story and UK economic data to influence exchange rates this month. At present we are awaiting the decision from the Supreme Court in regards to if UK Prime Minister Theresa May needs to seek Government...

Read More »FX Daily, January 04: Consolidation in Capital Markets

Swiss Franc EUR/CHF - Euro Swiss Franc, January 04(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has...

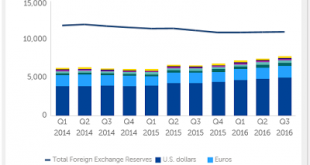

Read More »A Few Takeaways from the Latest IMF Reserve Figures

Summary: Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling’s share of new reserves warns it may be losing some allure. The IMF is the most authoritative source for reserve holdings of central banks. It reports the data at the end of each quarter with a quarter lag. At the end of last year, the IMF published the Q3 16 reserve figures. ...

Read More »FX Weekly Preview: What You Should Know to Start the First Week of 2017

Summary: Data has already been reported. Trends reversed in the last two weeks. US jobs data may disappoint. It will take a few more weeks to lift some of the uncertainty hanging over the markets. There are four things investors should know as the New Year begins. First, it has already begun with several PMI reports already reported. Second, in the last two week of the December, the trends that dominated Q4...

Read More »FX Daily, December 29: Dollar, Equities and Yields Fall

Swiss Franc EUR/CHF - Euro Swiss Franc, December 29(see more posts on EUR/CHF, ) - Click to enlarge FX Rates In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer. Some reports try to link the moves to the unexpected weakness in the US pending home sales, but this is a stretch and merely seeks to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org