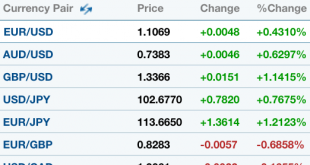

This post is motivated by recent headlines suggesting that the Chinese yuan has depreciated in recent days. Here’s an example: China’s yuan weakens to 5-1/2 low as c.bank tolerates depreciation This headline is completely inaccurate – the Chinese yuan has been appreciating in recent days. So that’s one problem I’d like to fix. I’d like to see the media start reporting accurate data on exchange rates, so that we know...

Read More »5.6.1. Crowther’s Balances and Imbalances of Payments: METI Paper

The former chief editor of “The Economist” Geoffrey Crowther published a great work on the development of balance of payments and current accounts over the long-term. It divides development into six phases, which are analogous to Shakespeare’s seven phases of life.The seven stages are: Young debtor nation, Mature debtor nation, Debt repayment nation, Young creditor nation, Mature creditor nation, Credit disposition /Asset Liquidation nation and the back to start stage Read our discussion...

Read More »3.4. More Thoughts on Negative Rates

The Bank of Japan surprised investors by introducing negative rates last week. Leave aside the fact that the negative rates do not go into effect for more than another week, and even when in effect, will apply to a relatively small amount of deposits at the central bank. The important point is that it is another central bank to introduce negative rates. Moreover, the yields of Japanese bonds through eight-year maturities have turned negative. In comparison, German yields are...

Read More »3.3. FAQ: The Why and What For of BOJ’s Negative Interest Rates

The Bank of Japan surprised investors last week by introducing negative interest rates. At the World Economic Forum in Davos a couple weeks ago, BOJ Governor Kuroda appeared to deny that such a move was under consideration. The market's focus, like ours, was on the pace by which it was expanding its balance sheet (JPY80 trillion a year). The FAQ format may be the most effective way to explain what the BOJ did, why and the implications for investors. What did the Bank of Japan do? ...

Read More »3.3. FAQ: The Why and What For of BOJ’s Negative Interest Rates

The Bank of Japan surprised investors last week by introducing negative interest rates. At the World Economic Forum in Davos a couple weeks ago, BOJ Governor Kuroda appeared to deny that such a move was under consideration. The market's focus, like ours, was on the pace by which it was expanding its balance sheet (JPY80 trillion a year). The FAQ format may be the most effective way to explain what the BOJ did, why and the implications for investors. What did the Bank of Japan do? ...

Read More »9. The Holy Grail of Long-Term Currency Movements: Crowther’s Balances and Imbalances of Payments

We call this chapter the holy grail of long-term currency movements because it is able to explain things like the sudden depreciation of the yen between October 2012 and April 2013 or the strengthening of the Chinese Yuan. The former chief editor of “The Economist” Geoffrey Crowther published a great work on the development of balance of payments and current accounts over the long-term. It divides development into six phases, which are analogous to Shakespeare’s seven phases of life. via...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org