Thanks for your patience. See you tomorrow. Japan: USD reached nearly JPY159.15, highest since late April. US Treasury added Japan to fx watchlist after recent intervention. USD up past six consecutive sessions coming into today. Japanese rhetoric about fx escalates. National CPI headline and core ticked up primarily utilities (electricity and gas). Excluding food and energy, CPI slowed to 2.1% from 2.4%. This was largely in line with the Tokyo CPI released a few...

Read More »Holiday Overview: The State of Play

FX: The dollar traded mostly higher last week. I suspect more near-term gains, but I am less convinced than I was a week ago. Given the FOMC minutes and more recent commentary from Fed officials, I suspect the market is exaggerating the chances of two cuts this year. That had been my leaning too, but I think the recent resilience of the labor market and sticky inflation has shifted the views at the Fed. The futures market is...

Read More »September Monthly

Three forces are shaping the investment climate. The US-China trade conflict escalates at the start of September as both will raise tariffs on each other’s goods and are threatening another round in mid-December (US 25% tariffs on $250 of Chinese imports will increase to 30% on October 1). Some third parties may benefit from the re-casting of supply chains, but the first impact is understood to weaken growth impulses. That is aggravating the slowdown already evident...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by...

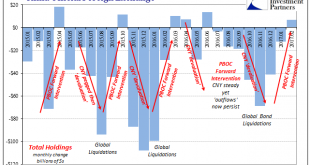

Read More »China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece. Yet, each and every time the delta pushes positive there is the same...

Read More »Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not...

Read More »Market Impact of a Trump Presidential Win

The probability of Republican Donald Trump winning the U.S. presidential election on November 8 seems remote at the moment—economists on Credit Suisse’s Global Markets team put it at less than 10 percent. So if it did happen, it would come as a major surprise for financial markets. The last time that kind of seemingly low-likelihood event came to pass—during last June’s Brexit vote—most investors were caught wrong-footed. So how might they best prepare for something as unexpected as President...

Read More »Are Central Banks Running Out of Steam?

In the old days, before the world was awash in capital with nowhere to go, an announcement of monetary easing was generally considered a good thing, a sign that central bankers were on the job. Historically, in all but the most extreme circumstances, lower interest rates have tended to spur economic activity, with the contemporaneous effect of supporting risky assets. But we are clearly living in an extreme circumstance, and after eight years of such announcements from central banks, it’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org