Overview: The record-long yen slide has stalled just shy of JPY129.50, even though the Bank of Japan defended its Yield-Curve Control cap on the 10-year bond and will continue to do so for the next four sessions. The greenback fell to almost JPY128 before steadying. China again defied expectations for lower rates (loan prime rate), the yuan’s sell-off accelerated and slide to its lowest level since last October. Chinese and Hong Kong shares fell, but most of the...

Read More »Binance Sets up at Paris’ STATION F to Develop the Web.3 Ecosystem in Europe

Binance, a global blockchain ecosystem and cryptocurrency infrastructure provider, announced the opening of its space in at the startup campus STATION F in Paris. This opening is part of the Objective Moon programme announced last November by Changpeng Zhao “CZ”, Founder and CEO of Binance. This programme poured in a €100 million investment in France to make the country the heart of the European crypto community. CZ said that Binance is committed to build and...

Read More »Swiss Blockchain Startup Wecan Chooses France for Its Expansion

Wecan Group SA, a Swiss Blockchain software provider used Swiss private banks, is favoring an expansion in France for its internationalization. Behind this choice: an investment from Michel Reybier, owner of La Réserve hotels, and a selection in the Swave program, an initiative of the French government to attract the most promising fintechs in France. 100 billion is the amount of assets under management of independent asset managers using the Wecan Comply platform....

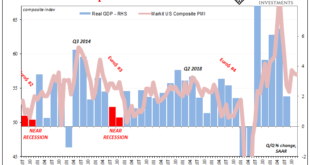

Read More »As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going. What PMI’s do have going for them is...

Read More »FX Daily, November 9: Falling Yields Give the Yen a Boost

Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, November 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that the Fed’s Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher...

Read More »Soaring Energy Prices Lift Yields, Weigh on Equities and the Greenback Pops

Overview: Rising energy prices and yields are helping lift the US dollar and weighing on equities. November WTI has pushed above $76, while Brent traded above $80, and natural gas is up for the fourth consecutive session, during which time it has risen by about 25%. The US 10-year yield has surged to almost 1.53%, up more than 20 bp since the middle of last week. Near 32 bp, the US 2-year yield is at a new 18-month high. European yields are 3-5 bp higher, with...

Read More »Risk Appetites Didn’t Return from the Weekend

Overview: Investors’ mood did not improve over the weekend, and the lack of risk appetites are rippling through the capital markets today. Equities have tumbled, yields have backed off, and the dollar is well bid. Hong Kong and Australia led the sell-off in the Asia Pacific region, off 3.3% and 2.1%, respectively. Regional losses may have been larger, but Japan, Chinese (mainland), and South Korea markets were on holiday. Europe’s Dow Jones Stoxx 600 is off 2%, the...

Read More »Risk Appetites Didn’t Return from the Weekend

Overview: Investors’ mood did not improve over the weekend, and the lack of risk appetites are rippling through the capital markets today. Equities have tumbled, yields have backed off, and the dollar is well bid. Hong Kong and Australia led the sell-off in the Asia Pacific region, off 3.3% and 2.1%, respectively. Regional losses may have been larger, but Japan, Chinese (mainland), and South Korea markets were on holiday. Europe’s Dow Jones Stoxx 600 is off 2%, the...

Read More »FX Daily, June 21: Dollar Surge Stalls

[unable to retrieve full-text content]Pressure on equities seen last week carried over into Asia and Europe today. The MSCI Asia Pacific Index fell for the fourth consecutive session, led by more than a 3% decline in the Nikkei. Australia, Taiwan, and Hong Kong bourses fell by more than 1%. European equities opened lower, but have turned higher.

Read More »FX Daily, January 08: Can the Dollar Find Traction Even if the Employment Data Disappoint?

Swiss Franc The Euro has fallen by 0.32% to 1.0825 EUR/CHF and USD/CHF, January 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global equity rally picked up this week as it closed in 2019. The MSCI Asia Pacific Index gained today and is up in nine of the past 10 sessions. It has fallen only in one week since the end of October. South Korea’s Kospi led today’s advance with a nearly 4% rally on the back...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org