While Western markets breathed a sigh of relief that US GDP didn’t confirm the global slowdown, not yet, what was taking place over in Asia went in the other direction. There has been a sense, a wish perhaps, that if the global economy truly did hit a rough spot it would be limited to just the last three months of 2018. Hopefully Mario Draghi is on to something. Therefore, Q4 US GDP wasn’t as bad as feared, cushioning...

Read More »GBP to CHF rate hovers over 1.32 awaiting new Brexit Developments

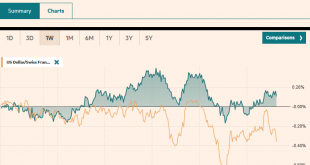

Swiss Franc CHF Exchange Rates Graph - Click to enlarge The pound has rallied higher against the Swiss Franc with rates for the GBP/CHF pair now sitting over 1.32. Pound to Swiss Franc exchange rates have been lifted on the back of some optimism over Brexit, that a deal will be reached between Britain and the EU. The markets are awaiting developments over the contentious Irish backstop which could pave the way...

Read More »FX Daily, March 01: Could the Worst be Behind China and Germany? Or Hope Springs Eternal

Swiss Franc The Euro has risen by 0.14% at 1.1364 EUR/CHF and USD/CHF, March 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that MSCI plans to substantially boost China’s equity weighting in its indices and a better than expected Caixin manufacturing PMI and some easing of India-Pakistan tensions helped bolster the risk-taking appetite going into the...

Read More »Switzerland GDP Q4 2018: +0.2 percent QoQ, +1.4 percent YoY

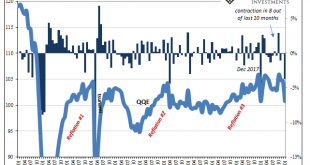

Switzerland’s GDP rose by 0.2% in the 4th quarter of 2018. Manufacturing saw dynamic growth. Concurrently, exports of goods increased significantly. In contrast, domestic demand stagnated. GDP growth was 2.5% for 2018 as a whole. Switzerland’s GDP rose by 0.2% in the 4th quarter of 2018.1 As in other European countries, this confirms a slowdown of the economy compared to the first half of the year. Switzerland Gross...

Read More »Federal Court rejects complaint against Volkswagen importer

Since 2015, the Volkswagen Group has paid more than €27 billion to settle investor and consumer lawsuits as well as regulatory fines and remedies tied to resolving excessive emissions levels in its diesel cars Switzerland’s highest court has dismissed a legal complaint by a consumer group against Amag, an importer of German Volkswagen diesel cars into Switzerland, linked to the emissions-rigging scandal. The Federal...

Read More »The Doomsday Scenario for the Stock and Housing Bubbles

It was always folly to believe that inflating asset bubbles could solve the structural problems of a post-industrial economy. The Doomsday Scenario for the stock and housing bubbles is simple: the Fed’s magic fails. When dropping interest rates to zero and flooding the financial sector with loose money fail to ignite the economy and reflate the deflating bubbles, punters will realize the Fed’s magic only worked the...

Read More »The Gold Debate – Where Do Things Stand in the Gold Market?

A Recurring Pattern When the gold price recently spiked up to approach the resistance area even Aunt Hilda, Freddy the town drunk, and his blind dog know about by now, a recurring pattern played out. The move toward resistance fanned excitement among gold bugs (which was conspicuously lacking previously). This proved immediately self-defeating – prices pulled back right away, as they have done almost every time when...

Read More »FX Daily, February 28: Trump Walks Away from North Korea. Should Beijing Worry?

Swiss Franc The Euro has fallen by 0.39% at 1.134 EUR/CHF and USD/CHF, February 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the US-North Korean summit ended abruptly without an agreement spurred losses in equities and gains in the Swiss franc and Japanese yen. US President Trump willingness to walk away from the talks is important in and of...

Read More »Good Year for Swiss Economy in 2018

Head of the Swiss State Secretariat for Economic Affairs (SECO), Marie-Gabrielle Ineichen-Fleisch, speaking in Geneva on Thursday. After some years of steady but low growth, the Swiss economy expanded by 2.5% in 2018 on the back of a positive global situation. The figures, released on Thursday by the Swiss State Secretariat for Economic Affairs (SECO), showed growth last year that was a hair below expected (+2.6%) but...

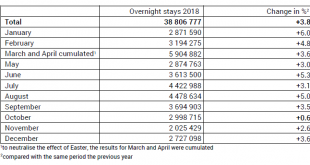

Read More »The Swiss hotel sector saw a new record number of overnight stays in 2018

26.02.2019 – The hotel sector in Switzerland registered 38.8 million overnight stays in 2018, i.e. the best result to date. This represented a growth of 3.8% (+1.4 million) compared with 2017. Foreign demand totalled 21.4 million units, an increase of 4.5% (+921 000) and its best performance in 10 years. Swiss overnight stays increased by 2.9% (+493 000), thus reaching the record value of 17.4 million overnight stays....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org