When planning for retirement, most people focus on savings, investments, and budgeting for daily living expenses. However, one critical component that often gets overlooked is an emergency fund. Having an emergency fund in retirement is essential for maintaining financial stability and peace of mind. Unexpected expenses, such as medical bills or home repairs, can derail even the most carefully constructed financial plan. This guide explains the importance of...

Read More »Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

• Arizona plant strategische Bitcoin-Reserve<br> • Gesetzentwurf wurde verabschiedet<br> • Endgültige Genehmigung steht noch aus<br> <!-- sh_cad_1 --> Arizona unternimmt einen bedeutenden Schritt in Richtung Krypto-Adaption: Ein neuer Gesetzentwurf, der es dem US-Bundesstaat erlaubt, öffentliche Gelder in <a... [embedded content]...

Read More »So bewegen sich Bitcoin & Co. heute

Der <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a>-Kurs zeigt sich gegenüber dem Vortag um 17:11 mit roten Vorzeichen. Zuletzt verlor <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a> -0,56 Prozent auf 97'030,78 US-Dollar, nachdem am Vortag noch 97'575,76 US-Dollar an der Tafel gestanden hatten.<!-- sh_cad_1 -->In der Zwischenzeit muss <a... [embedded content]...

Read More »Aktueller Marktbericht zu Bitcoin & Co.

<a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a> reduzierte sich um 12:25 um -0,29 Prozent auf 97'292,60 US-Dollar, nachdem er am Vortag bei 97'575,76 US-Dollar gelegen hatte.<!-- sh_cad_1 -->Nach 332,72 US-Dollar am Vortag ist der <a href="/devisen/bitcoin-cash-dollar-kurs">Bitcoin Cash</a>-Kurs am Sonntagmittag um 0,54 Prozent auf 334,53... [embedded content]...

Read More »Coinbase-Chef Brian Armstrong: Neue Listing-Pläne – Bitcoin auf dem Weg zu Millionen?

• Coinbase-CEO will Token-Listing überarbeiten<br> • Kritik an den aktuellen Listing-Richtlinien<br> • Coinbase-CEO hält langfristig Bitcoin-Preis in Millionenhöhe für möglich<br> <!-- sh_cad_1 --><h2>Coinbase-CEO: Token-Listing muss überarbeitet werden</h2> Am 26. Januar 2025 kündigte <a href="/aktien/coinbase-aktie" target="_blank"... [embedded content]...

Read More »Die Performance der Kryptowährungen in KW 7: Das hat sich bei Bitcoin, Ether & Co. getan

So bewegten sich die einzelnen Kryptowährungen in der Kalenderwoche 7: [embedded content] Tags: Featured,newsletter

Read More »The Stability-Instability Paradox

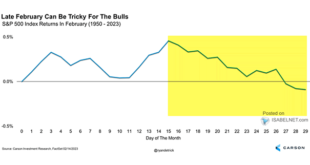

Inside This Week's Bull Bear Report The Stability-Instability Paradox How We Are Trading It Research Report - Tariffs Are Not As Bearish As Headlines Suggest Youtube - Before The Bell Market Statistics Stock Screens Portfolio Trades This Week Market Shakes Off Inflation Data I am back from traveling, and we have a good bit to catch up on since our last report. If you missed it, I provided an update on Tuesday, updating all the weekly technical and...

Read More »GameStop-Aktie im Aufwind: Steht eine Bitcoin-Investition nach Strategy-Vorbild bevor?

• Vorstand hat 2023 neue "Investitionsrichtlinie" genehmigt<br> • Plant GameStop Investition in Bitcoin? • Auf X veröffentlichtes Foto sorgt für Spekulationen <!-- sh_cad_1 --><br><br> <h2>Wird GameStop in Bitcoin investieren?</h2> Wie CNBC unter Berufung auf drei mit der Angelegenheit vertraute Quellen berichtet, erwägt <a... [embedded content]...

Read More »The Impact Of Tariffs Is Not As Bearish As Predicted

There are many media-driven narratives about the impact of tariffs on the economy and the markets. Most of them are incredibly bearish, predicting the absolute worst possible outcomes. For fun, I asked ChatGPT what the expected impact of Trump's tariffs will likely be. Here is the answer: "One of the immediate consequences of increased tariffs is higher consumer prices. Tariffs function as an import tax, and companies that rely on foreign goods often pass these...

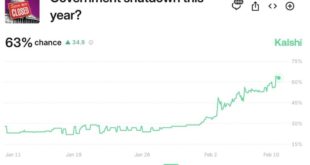

Read More »The Fiscal Freeze Is Coming

In mid-March, the government is expected to hit the debt ceiling. As has seemingly become the norm, dire threats from both political parties will start shortly. However, despite the fiery rhetoric, they often get resolved before the government shuts down. Might the coming fiscal standoff be a little different? Our colleague Greg Valliere, a long-time Washington DC insider, explains why a shutdown may be more likely this time. Greg starts his latest article by asking...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org