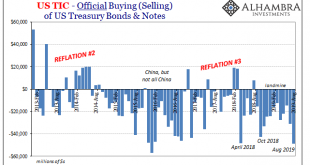

The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat. So, how smart can Eurobond agents really be if they’ve gone and done it again? What is it? Let’s roll the clock back to the landmine of 2018. Collateral shortage,...

Read More »August TIC: Trying To Get Collateral Out of the Shadows

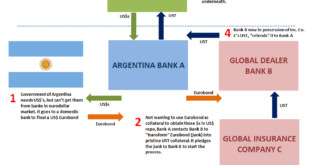

The second most frustrating aspect of trying to analyze global shadow money is how the term “shadow” really applies in this case. It’s not really because banks are being sneaky, desperately maintaining their cover for any number of illicit activities they are regularly accused of undertaking. The money stays in the shadows for the simple reason central bankers don’t know their jobs; even after a somehow Global Financial Crisis in 2008, they don’t realize the full...

Read More »Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Update December 2016: Italians rejected the referendum that seeks to increase power of the prime minister and reduce power of the two chambers parliament. Prime minister Renzi has promised to resign. This opens the door for new elections, in which the anti-euro parties Movimento 5 stelle (5 star movement) and Lega Nord (Northern League) may strengthen. ————————————————————————————— Update December 2013: Bear in mind...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org