They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing. But who was falling for it? The stock market, sure. Investors on Wall Street are still betting as if it will work any day...

Read More »More Than A Decade Too Late: FRBNY Now Wants To Know, Where Were The Dealers?

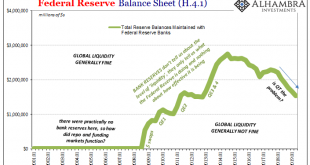

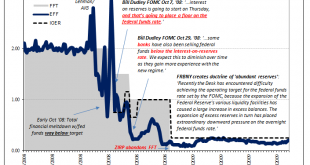

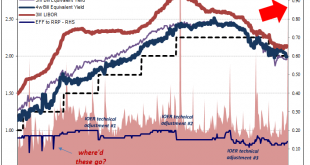

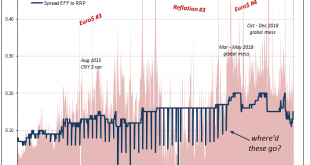

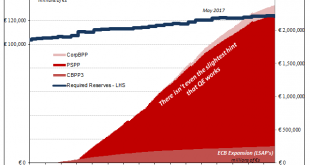

I’ve said it all along; focusing in on bank reserves would leave you dazed and confused. It’s just not how the system works. After all, as I pointed out again not long ago, “our” glorious central bank had the audacity to claim that there were “abundant” reserves during the worst financial panic in four generations. “Somehow” despite that, it was a Global Financial Crisis that lived up to its name – global. Straight away you have to ask, what good are reserves if...

Read More »Stuck at A: Repo Chaos Isn’t Something New, It’s The Same Baseline

Finally, finally the global bond market stopped going in a straight line. I write often how nothing ever does, but for almost three-quarters of a year the guts of the financial system seemed highly motivated to prove me wrong. Yields plummeted and eurodollar futures prices soared. It is only over the past few weeks that rates have backed up in what has been the first real selloff since last year. Is this a meaningful change? It may seem that way in certain places....

Read More »How To Properly Address The Unusual Window Dressing

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses. Among the more prominent of these was Basel 3’s leverage ratio....

Read More »February 2019 PBOC/RMB Update

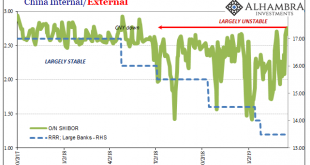

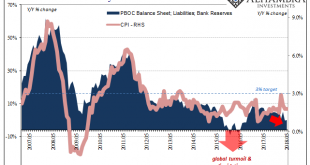

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions (here’s another). China...

Read More »More Unmixed Signals

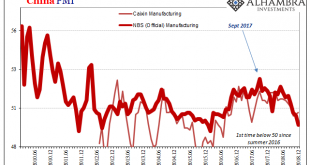

China’s National Bureau of Statistics (NBS) reports that the country’s official manufacturing PMI in December 2018 dropped below 50 for the first time since the summer of 2016. Many if not most associate a number in the 40’s with contraction. While that may or not be the case, what’s more important is the quite well-established direction. Coming in at 49.4 in December, it’s down in a straight line from 51.3 in August....

Read More »Sometimes Bad News Is Just Right

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019). We won’t know the full details...

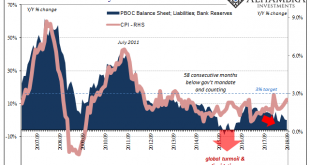

Read More »Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm. The Chinese had a pork problem in...

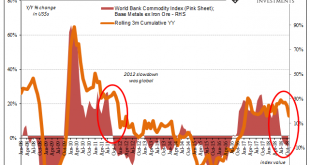

Read More »Chinese Inflation And Money Contributions To EM’s

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen. Authorities are not simply contracting one important form of...

Read More »Brent’s Back In A Big Way, Still ‘Something’ Missing

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status. Later on, governments...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org