What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Natural rights and the American border

The American immigration system is far from easily navigable. Those who proudly declare that they are “all for immigration as long as it is legal” may be unfamiliar with how convoluted the immigration system is. The described “crisis” usually relates largely to how many immigrants there are in legal limbo. These immigrants in limbo are mostly those who are legally seeking immigration or acceptance as a refugee but are turned away without reason. Many wait in the U.S....

Read More »The CIA’s assassination plots

The attempt to assassinate Donald Trump and his heroic response to it are uppermost in our minds. We don’t yet know the details of who was involved in the attempt on his life, though I suspect that the “lone gunman” theory will turn out to be false. But the sad event offers us a chance to reflect on something that we do know, and that may well be relevant to the attempt on the former—and we trust soon to be next—president’s life: The CIA has been involved in numerous...

Read More »When chickens become a weapon of woke politics

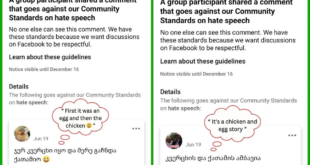

Girchi is a libertarian party from the country of Georgia and by electoral success, could be considered to be one of the most successful libertarian parties in the world. Girchi is famous for its internet presence and popularity all over social media. In the chaotic digital realm of Facebook, Girchi’s private group has long stood as a beacon of civilised discourse, having 25k members and still growing.In this group, we take great satisfaction in our ability to have...

Read More »Assassination Revisionism

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Our graduates need books

With your support, the Mises Institute can send Mises University students home with a stack of Austrian classics such as “Human Action”; “Man, Economy, and State”; and “The Case for Gold” (see full list at the bottom of this email). After a week of destroying every preconceived, state-curriculum notion of how the world works, Mises U grads will have another month before returning to college in the fall. Our graduates can continue to dive into their...

Read More »CBDC currency: Creating shortages with full shelves

Of all the areas that economics students need to master, counterfactual reasoning is near the top of the list. Counterfactual reasoning is outlining and comparing the differences and similarities between two alternatives. While everyone uses counterfactual reasoning, such as choosing what to have for lunch, economists look at deeper and more remote consequences. A typical example that students are asked to examine is the effects of price controls — what happens when...

Read More »Rothbard in 1972: Another Lone Nut?

This first appeared in The Libertarian Forum, Vol VI, NO.6-7, June-July,1972, following the attempted assassination of Presidential candidate George Wallace.John F. Kennedy; Malcolm X; Martin Luther King; Robert F. Kennedy; and now George Corley Wallace: the litany of political assassinations and attempts in the last decade rolls on. (And we might add: General Edwin Walker, and George Lincoln Rockwell. In each of these atrocities, we are fed with a line of cant from...

Read More »Though popular, nationalizations ruin economies

In a world full of hatred for the free market, the people calling for the nationalization of industry aren’t scarce. Despite their political popularity, nationalizations are terrible for economies and represent a stepping stone on the path to destitution and collapse. In exchange for the temporary gain achieved by expropriating the property of others, countries sacrifice the confidence of doing business in their nation.Nationalization stems from the error that the...

Read More »Choose one: Law enforcement at Trump shooting was either incompetent or complicit

Within minutes of the July 13 attempted assassination of Donald Trump, observers were asking how the assassin managed to gain a clear shot of Donald Trump at the Butler Farm Show Grounds near Butler, Pennsylvania. Since then, the question remains unanswered, but many allegations about the shooting have emerged. For example, multiple sources plausibly contend that both local police and the Secret Service had spotted the armed shooter—on a nearby roof with a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org