Lot No 210, a 1937 coin set comprising gold sovereigns and £5 coins in a leather case, which sold for £8,000. Photograph: Wotton Auction Rooms ◆ Gold coins including gold sovereigns found in drawers of deceased retiree’s cottage sell at auction for £80,000 ◆ British gold coins including gold sovereigns from the Royal Mint found in drawers and cupboards of cottage fetch £80,000; one British gold sovereign found in a sugar bowl ◆ Auctioneer John Rolfe expected little...

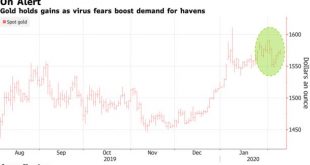

Read More »Gold Consolidates Near Six Year Record Highs At $1574/oz; WHO’s ‘Tip of the Iceberg’ Virus Warning

via Bloomberg Gold climbed for a fourth day as investors weighed the unfolding coronavirus crisis, including a stark warning from the head of the World Health Organization about the potential for more cases beyond China and signs the disease is spreading in the key Asian trading hub of Singapore. Prices rose as the death toll from the outbreak topped 900 and WHO Director-General Tedros Adhanom Ghebreyesus voiced concern over the spread from people with no travel...

Read More »“Smart Move” By Prudent Investors Is To Diversify Into Gold

by Randall W. Forsyth via Barron’s ◆ With no opportunity cost to holding a zero-yield asset such as gold, investors increasingly are adding it to their portfolios as a hedge. ◆ Gold retains its intrinsic value, something no paper currency has managed to do over history. ◆ Gold is insurance. Insurance isn’t supposed to make you rich; it’s supposed to keep you from being poor. The best thing to happen is your insurance never pays off because nothing bad happens. ◆...

Read More »Gold Falls 0.6percent After Having A Seven Year Weekly High Close and 4percent Gain In January

Gold falls from seven year high weekly close◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at $1587.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb. ◆ Chinese stocks crashed over 7.7% overnight as investors got a chance to react to the worsening coronavirus outbreak which also saw European equities seeing some selling and economically sensitive...

Read More »Gold May Top $2,000 As “Prices Surge On Global Fear”

by Paul R. La Monica via CNN Business Gold was one of the few investments heading higher Monday as worries about the coronavirus outbreak led to a steep market slide. Gold is now up more than 20% in the past year, and trading near $1,600 an ounce, its highest level since 2013. Other precious metals, such as silver and platinum, have rallied too. Meanwhile, the Dow was down nearly 350 points in midday trading. Some experts wonder if gold could top $2,000 in the...

Read More »“All You Need To Do Is Own Gold and Silver” To Make Money In 2020

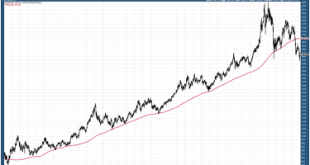

If you want to make money from investing, it’s simple: find a bull market and go long. And in 2020 gold and silver are in a bull market. by Dominic Frisby via the UK’s best-selling financial magazine Money Week I ran into Jim Mellon at a party at the weekend, and we soon got talking about markets. One of his comments – stated with surety and simplicity – has stuck in my mind. “Investing in 2020 is going to be easy,” he said. “All you need to do is own gold and...

Read More »Why Do Prudent Indians Diversify Into Gold?

◆ Indians diversify into gold coins, bars and jewellery because it never fails them in an emergency ◆ Indians are simply very prudent and practical and believe in channeling some of their wealth and saving into physical gold ◆ “A woman’s gold is both her personal treasure and plays a functional role as the family’s financial buffer” – Richard Davies ◆ Gold is an ‘obsession’ for very few people in the world today, including Indians, and most owners simply view it as a...

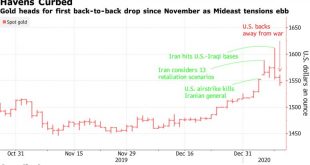

Read More »Gold Steadies After Falls As U.S., Iran Stepping Back From the Brink

◆ Haven demand ebbs as stocks climb with easing Mideast tensions ◆ Palladium retreats from fresh record but holds near $2,100 ◆ There’s still very strong demand for gold “due to a host of financial, geopolitical and monetary risks,” said Mark O’Byrne, research director at GoldCore Full article on Bloomberg Gold Posts First Loss in 11 Sessions as Trump’s Speech Ebbs Iran War Worries via Marketwatch ◆ Yellow metal falls from highest levels since 2013 ◆ Gold prices...

Read More »Gold’s New Bull Market and Why $7,000 Per Ounce Is “Logical” (Part I)

◆ Gold could rise to more than $7,000 an ounce according to respected MoneyWeek contributor and fund manager Charlie Morris (Part I today and Part II tomorrow) A year ago, in my occasional free newsletter, Atlas Pulse, I upgraded gold – which was trading at $1,239 an ounce at that point – to “bull market” status for the first time since 2012. Unlike the gold bugs, I’m not a broken record. And unlike the barbarous relic brigade, I recognise gold’s importance in the...

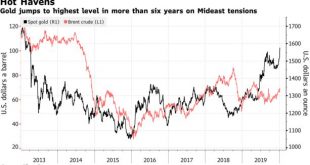

Read More »Gold Surges To Test $1,600/oz, Oil Over $70, Stocks Fall on Risks of World War In Middle East

◆ Gold has surged to test $1,600 per ounce, up 4% so far in 2020 and building on the stellar near 18.9% gain in 2019 ◆ Gold is testing it’s highest levels since 2013 as investors diversify into gold; Goldman, Citi and other gold analysts are advocating gold bullion as important hedge in crisis ◆ Oil prices have surged with Brent crude reaching $70 per barrel; concern over oil supplies from Iran, Iraq and other nations as U.S. State Department warns of attacks on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org