The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing. What was going on in the shadows wasn’t...

Read More »China Going Back To 2011

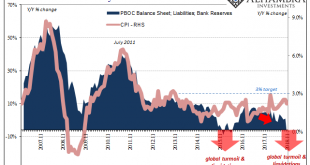

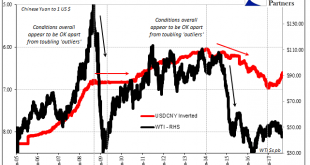

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of...

Read More »Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is...

Read More »Le casino américain est le grand gagnant de la crise de 2011. Liliane Held-Khawam

La crise de 2011 a été un tournant dans la guerre monétaire, financière et économique menée de main de maître par le casino financier mondial. La guerre sévit partout dans le monde. Les exactions spectaculaires des jihadistes dans certaines zones ne devraient pas nous cacher l’autre guerre qui agite le monde dans ses moindres recoins. Une guerre globale accompagne la mondialisation des marchés et l’émergence d’une élite apatride autoproclamée. Cette guerre est monétaire et planétaire. ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org