The corona crisis has already taken a very high toll and caused deep damage in our societies and our economies, the extent of which is yet to become apparent. We have seen its impact on productivity, on unemployment, on social cohesion and on political division. However, there is another very worrying trend that has been accelerated under the veil of fear and confusion that the pandemic has spread. The war on cash, already underway for almost a decade, has been...

Read More »BBH’s Marc Chandler Calls Bitcoin ‘Inefficient’

BITCOIN and ETHEREIM CRCACKER LATEST WORKING JUNE 2020 https://bit.ly/3eMLB5E https://easyupload.io/opdktp https://www.sendspace.com/file/lim1hi

Read More »BBH’s Marc Chandler Calls Bitcoin ‘Inefficient’

BITCOIN and ETHEREIM CRCACKER LATEST WORKING JUNE 2020 https://bit.ly/3eMLB5E https://easyupload.io/opdktp https://www.sendspace.com/file/lim1hi

Read More »FX Daily, June 30: When Primary is Secondary

Swiss Franc The Euro has fallen by 0.40% to 1.0647 EUR/CHF and USD/CHF, June 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday’s gain. Energy and financials are the biggest drags, while real estate and...

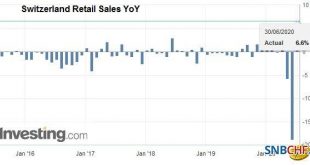

Read More »Swiss Retail Sales, May 2020: 5.6 percent Nominal and 6.6 percent Real

30.06.2020 – Turnover adjusted for sales days and holidays rose in the retail sector by 5.6% in nominal terms in May 2020 compared with the previous year. Seasonally adjusted, nominal turnover rose by 30.2% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 6.6% in May 2020 compared with the previous year. Real growth takes...

Read More »Tally Weijl to close quarter of stores

Tally Weijl, which sells clothing for women and teenage girls, was founded in 1984 Keystone / Georgios Kefalas Swiss fashion chain Tally Weijl will close 200 of its 800 stores internationally and withdraw completely from Bulgaria. In Switzerland, it will close between five and ten of its 81 stores. However, the company says it has secured financing. The Basel-based retail chain said in a statement on Monday its aim was to strengthen its online presence and retain...

Read More »Cool Video: Forces Driving the Dollar and Downplaying Claims Sterling is an Emerging Market Currency

From my remote location in Ocean Grove (next to Asbury Park of Bruce Springstein fame), I joined Martin Soong and Sir Jegarajah for a brief interview as the Asia session was about to begin the new week. A three-minute clip of the interview can be found here. I suggest that there are two main drivers of the markets now. There is the fear of the new surge in Covid cases and the economic implications, on the one hand, which discourages risk-taking. On the other hand,...

Read More »Dollar Begins the Week Under Pressure Again

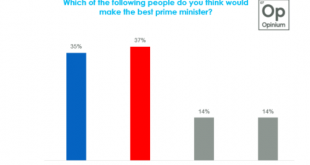

The virus news stream remains negative; pressure on the dollar has resumed The US economy is taking a step back just as Q3 is about to get under way; there are some minor US data reports today UK Labour leader Starmer overtook Prime Minister Johnson in the latest opinion poll; Macron’s party did poorly in French local elections French and German leaders meet to discuss the planned EU pandemic rescue package; UK and EU begin their “intensified timetable” for Brexit...

Read More »Looking Ahead Through Japan

After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China. Three days in, news reached the Diamond that the Communists had closed down the affected region....

Read More »FX Daily, June 29: USD is Offered in Quiet Start to the New Week

Swiss Franc The Euro has risen by 0.29% to 1.0671 EUR/CHF and USD/CHF, June 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The combination of rising virus cases and the sell-off in the US before the weekend dragged nearly all the Asia Pacific bourses lower. The Nikkei led the way with more than a 2% drop, but most bourses were off more than 1%. China and Taiwan were also greeted with selling as markets...

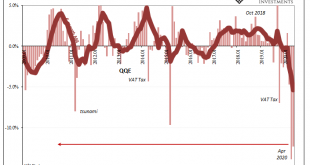

Read More » SNB & CHF

SNB & CHF