China was instructed by the IMF that as an operational requirement for joining the SDR that the gap between the onshore and offshore yuan (CNY and CNH respectively) needed to close. This was important for central banks to hedge. The opposite is taking place. That is what this Great Graphic, created on Bloomberg depicts. The yellow line is CNH. The white line is CNY. When PBOC facilitated a mini-devaluation in August, the spread widened out. However, in September and October, as it...

Read More »Morning Edge – SPECIAL – Interview with Marc Chandler along with Chris Bayer – 12/10/15

Note; Recording contains some sound drops due to unresolved internet problems. Blake (@PipCzar) interviews Marc Chandler. Marc Chandler has been covering the global capital markets in one fashion or another for more than 25 years, working at economic consulting firms and global investment banks. Chandler attended North Central College for undergraduate work, where he majored in political science and the humanities. He holds master's degrees from Northern Illinois University and University...

Read More »Morning Edge – SPECIAL – Interview with Marc Chandler along with Chris Bayer – 12/10/15

Note; Recording contains some sound drops due to unresolved internet problems. Blake (@PipCzar) interviews Marc Chandler. Marc Chandler has been covering the global capital markets in one fashion or another for more than 25 years, working at economic consulting firms and global investment banks. Chandler attended North Central College for undergraduate work, where he majored in political science and the humanities. He holds master's degrees from Northern Illinois University and University...

Read More »Greenback Recovers, but Antipodeans Advance

There are two broad themes among the major currencies today. The first is the pullback in the euro and yen after yesterday's run-up. Position adjustments with the help of stop losses seemed to be the key consideration. Both the euro and yen extended the recovery seen in the second half of last week. Year-end considerations, both in terms of positioning and less liquidity, likely played a role as well. The second broad theme is the relative strength of the Australian and New Zealand...

Read More »Monetary assessment meeting Swiss National Bank

#Jordan negative inflation rate only temporary, caused by oil and price adjustments of imported goods, globally also low inflation #CHF #SNB — George Dorgan (@DorganG) December 10, 2015 #jordan Swiss sovereign money initiative means a complete change of financial system, #SNB needs longer evaluation #vollgeld #CHF — George Dorgan (@DorganG) December 10, 2015 #jordan Swiss deflation mostly caused by exchange rate and oil. No deflationary risks #chf #snb — George Dorgan (@DorganG)...

Read More »Switzerland is becoming a retirement home

By 2045 the Swiss population will grow to over ten million. Pensioners are the fastest growing segment of society. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Will The Franc Follow In The Euro’s Footsteps?

The SNB’s expected December 10 rate cuts have already been priced in to the Swiss Franc. The central bank’s failure to do more than the market expected resulted in a stronger CHF. Growing uncertainty over the Fed’s 2016 monetary policy is a bullish factor for the franc. As they watched the euro strengthen following the ECB’s meeting, SNB representatives rubbed their hands in glee. However, by the start of the Asian FOREX session, the franc was already recovering from its wounds. Now, Bern...

Read More »France, Schengen and the Future of Europe

The second round of French regional elections will be held this weekend. The first round last weekend saw the National Front do best in terms of popular votes and led in six of the twelve regions. The National Front is not simply anti-austerity, but it is anti-EMU. In regions that NF garnered more than 40% of the vote, the Socialists have withdrawn their candidate and urged their supporters to vote for the center-right candidate to boost the chances of defeating NF. Sarkozy, who...

Read More »SNB’s history of balance sheet and Monthly bulletin

Since 2015, the SNB provides its balance sheet items in a different form. Previously the monthly bulletins provided a history of the balance sheet. The last monthly bulletin appeared for August 2015. It contained all important data of the SNB and the Swiss economy. The balance sheet data is often 2 months or older. The weekly monetary data and the IMF data about FX reserves and more are published a lot more quickly, but they are not that complete like the monthly bulletin. SNB...

Read More »Dollar Bloc Remains Soft, but Euro, Sterling and Yen Firm

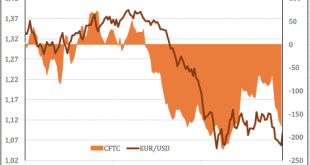

The US dollar continues its mixed performance. The fragile stability of commodity prices today is not lending much support to the Australian and New Zealand dollars though the Canadian dollar is flat after yesterday's slide. The euro has pushed above $1.09 for the first time this week. We had suggested a $1.08-$1.10 range would likely dominate this week. Technically, it appears poised to test the upper end of that range. Stops above the $1.1010 retracement objective could carry the...

Read More » SNB & CHF

SNB & CHF