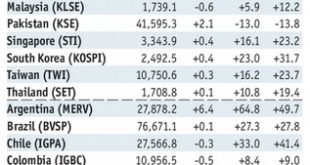

Summary President Xi Jinping’s concepts of socialist thinking were written into China’s constitution. Malaysia Prime Minister Najib presented an expansionary budget for 2018 ahead of elections. Czech billionaire Andrej Babis’ ANO party won the elections. South Africa’s mid-term budget statement acknowledged the deteriorating outlook but offered little in the way of solutions. Press reports suggest Germany is working to...

Read More »Cool Video: A Tentative Answer to the Low Vol Question

I had the privilege of joining the set of anchors Julie Cchatterley, ScarletFu, and Joe Weisenthal on the set of “What’d You Miss” today. The unrehearsed discussion took an unexpected turn when Joe asked about the low volatility. The anchors were patient and gave me time to provide a sketch of the thesis of my book, Political Economy of Tomorrow, where I suggest a under appreciated factor in the low price of capital is...

Read More »Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class. And once we know what sort of...

Read More »Political Economics

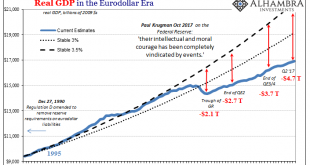

Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed. Still, politically, it does matter to some significant degree. It’s just that the political division isn’t...

Read More »Charles Hugh Smith Will The Private Sector Grow Fast Enough To Meet The Demands Of The Public Sector

Click here for the full summary: http://financialrepressionauthority.com/2017/10/27/the-roundtable-insight-charles-hugh-smith-on-will-the-private-sector-be-able-to-grow-fast-enough-to-meet-the-demands-of-the-public-sector/

Read More »FX Daily, October 27: Greenback Finishing Week on Firm Note

Swiss Franc The Euro has fallen by 0.16% to 1.1602 CHF. EUR/CHF and USD/CHF, October 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates This has been a good week for the US dollar. The Dollar Index’s 1.25% gain this week is the largest of the year. The driver is two-fold: positive developments in the US and negative developments abroad. The positive developments in the US...

Read More »Most young Swiss keep informed online

Social media is becoming increasingly dominant in the Swiss media industry, controlling not only consumer habits but also the advertising market. In addition, television is dying. These are the findings of the latest “Yearbook Quality of the Media” by the University of Zurich. They are strong, they are dominant, they have money – and they are located outside the Swiss sphere of influence: the internet giants or “tech...

Read More »Interview: La crise planifiée par nos élites mondiales, Jim Rickards/Bill Bonner. Publications Agora

Ne déposez pas UN SEUL CENTIME sur votre compte en banque avant d'avoir lu ce livre : https://pro.publications-agora.fr/m/990250 La Bourse au Quotidien : http://labourseauquotidien.fr Suivre la BAQ sur Twitter : https://twitter.com/AgoraBAQ -- NOS PUBLICATIONS GRATUITES -- Publications Agora : http://publications-agora.fr La Chronique Agora : http://la-chronique-agora.com La Quotidienne de la Croissance : http://quotidienne-agora.fr

Read More »Russia Buys 34 Tonnes Of Gold In September

– Russia adds 1.1 million ounces to reserves in ongoing diversification from USD – 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest – Russia’s gold reserves are at highest point in Putin’s 17-year reign – Russia’s central bank will buy gold for its reserves on the Moscow Exchange – Russia recognises gold’s role as independent currency and safe haven Russian Central Bank Gold Reserves, 2006 -...

Read More »Housing Isn’t Just About Real Estate

The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year. On an annual basis, resales in September were 1.5% less than those in September 2016. It was the first...

Read More » SNB & CHF

SNB & CHF