The shift to tighter monetary policies in the West is weakening credit markets. Over-indebted emerging markets face headwinds from rising borrowing costs and dollar shortages… Investors need to focus on their response to financial stresses in an era in which policymakers will be constrained.

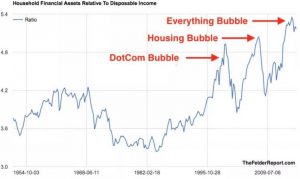

The “everything bubble” is deflating. The fact that it’s happening relatively slowly shouldn’t blind us to the real threat: The world is dangerously underestimating how hard it’ll be to deal with the fallout once it pops.

Frothy markets can’t disguise the warning signs. The shift to tighter monetary policies in the West is putting pressure on global equity and real estate values. Even more critically, it’s weakening credit

Articles by Satyajit Das

The Twilight Of The Gods (aka Central Bankers)

May 9, 2016The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

First, the measures implemented since 2009 created an artificial stability and an asset price boom in many markets.

But the absolute rate of GDP expansion and level of price changes is inadequate to solve global debt problems.

Second, new initiatives seem the risky response of clever but desperate individuals who have run out of ammunition and ideas. The actions of central bankers reflect George Santayana’s observation that “fanaticism consists in doubling your efforts when you have forgotten your aim”.

Central to this debate is negative interest rate policy (“NIRP”), now in place in Europe and Japan and under consideration in many other countries. NIRP will not create borrowing driven consumption and investment which generates stronger growth. Existing high debt levels, poor employment prospects, low rates of wage growth and over-capacity have lowered potential growth rates, sometimes substantially.

NIRP is unlikely to create inflation, despite central banker’s stubborn belief that increasing money supply can and will ultimately always create large changes in price level.

There are concerns about toxic by-products.

Read More »