Summary:

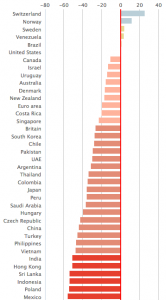

Swiss policymakers consider their domestic currency (the franc, or CHF) to be significantly overvalued.

Measures taken by the Swiss National Bank seem to corroborate this stance, holding its nominal overnight rates well into negative territory.

Considering where the Fed and ECB are in their policy cycles and where the SNB is in its cycle, the USD and EUR are likely to appreciate against the CHF.

The CHF could nonetheless be a source of safe haven flows depending on events in the EU occurring over the near-term.

Basic argument: There is always the risk of safe haven inflows depending on what occurs in the EU politically or otherwise, but the Swiss franc (NYSEARCA:FXF) is still a currency pointing downward.

Switzerland’s (NYSEARCA:EWL)(NASDAQ:FSZ) growth and inflation data remain weak compared to the US and even compared to the Eurozone (BATS:EZU) generally, which will likely cause the Swiss National Bank (“SNB”) to lag behind other developed economies with respect to any tightening initiatives (with the exception of Japan (NYSEARCA:EWJ)).

Overview

The Swiss franc is a difficult currency to figure out. The Swiss economy is subject to a monetary regime holding some of the most accommodative policy in the world and an economic model that still largely depends on exports.