It’s finally coming. Inflation. President-Elect Donald Trump’s promised a whole lot of infrastructure spending, raising the prospects for a great slug of price pressure the likes of which we haven’t seen in years.

Analysts’ forecasts and financial markets show a dramatic shift in view on the outlook for inflation. These charts show some metrics worth watching.

Investors have raised bets on a price pickup.

Inflation’s for Real. No, Really.

A year-end pickup in five-year, five-year forward inflation-swap rates shows investors are expecting faster price gains

Inflation’s for Real. No, Really. – Click to enlarge

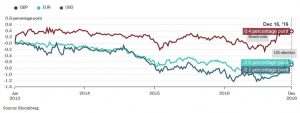

And economists see big things happening in 2017 in the U.S. and U.K.

Economists forecast inflationEconomists forecast inflation will soon break through U.S. and U.K. central banks’ goals – Click to enlarge

The jump in U.S. Treasury yields tells the same story.

The yield curve jumped up after the U.S. election, especially at the longer end – Click to enlarge

It looks like the Great Rotation out of fixed income is really happening. The key for investors will be whether any surge in growth is enough to sustain a fire under prices.

Next year will start with a lot of people positioned pretty much the same way.