During his 2024 presidential campaign Donald Trump repeatedly and in grave terms highlighted the possibility of the US dollar losing its world reserve currency status. This occurred at summits with business leaders at the New York and Chicago Economic Clubs.Trump occupies a rather unique position in this debate since he recognizes the real possibility of the dollar losing its world currency status, he opposes this change and wishes to prevent it, and yet he is not a paradigmatic member of the ruling class. However mainstream he is—today or in the past—he doesn’t possess the establishment credentials of a Ben Bernanke, for instance.Since Trump doesn’t want the dollar to lose reserve currency status, his acknowledgment that this is a real possibility should at least

Read More »Articles by J.R. MacLeod

Understanding the Basics of Modern Banking

October 7, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »President Bukele Broaches Austrian Business Cycle Theory at CPAC

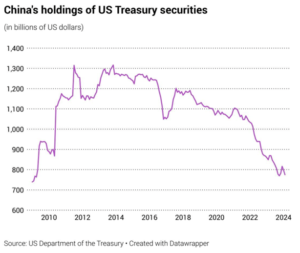

March 14, 2024President Nayib Bukele of El Salvador recently spoke at the Conservative Political Action Conference, receiving a hero’s welcome in the wake of his re-election victory. Yet he also delivered some hard truths as part of his speech that conservatives would do well to consider.While conceding that high taxes are a problem, Bukele said the deeper problem is that Americans “pay high taxes only to uphold the illusion that you are funding the government, which you are not.” Related to this, he gave a brilliant concise description of how the American government is financed:…by treasury bonds, paper. And who buys the treasury bonds? Mostly the Fed. And how does the fed buy them? By printing money! But what backing does the Fed have for that money being printed? The

Read More »GDP is a Poor Measure of Economic Health

February 15, 2024Gross domestic product (GDP) is the most common measure of national wealth and economic growth. Yet the layman—and even many businessmen and economists—is taken aback when mainstream commentators and professionals get very excited about changes to GDP, which seem to have little to no impact on real economic conditions. While GDP can sometimes reflect real economic conditions, this is often when conditions are very favorable or unfavorable and where other techniques would still give a better indication of economic conditions, how those conditions developed, and how they could be changed.

The fundamentals of calculating GDP are C + I + G + (X − M) = GDP, where

C = personal consumption expenditures

I = gross private domestic investment

G = government consumption

Bank of England Economist: Britons Need to Accept That They’re Poorer

June 3, 2023Although the Bank of England is largely responsible for inflation in the UK, its leaders blame British consumers and workers for the price increases.

Original Article: "Bank of England Economist: Britons Need to Accept That They’re Poorer"

[embedded content]

Tags: Featured,newsletter

Read More »Silicon Valley Bank and the Failure of Fractional Reserve Banking

March 23, 2023The story of the failure of Silicon Valley Bank is the story of nearly every bank failure. Fractional reserve banking invites the risky behavior that brings down the banking system.

Original Article: "Silicon Valley Bank and the Failure of Fractional Reserve Banking"

This Audio Mises Wire is generously sponsored by Christopher Condon.

[embedded content]

Tags: Featured,newsletter

Read More »Silicon Valley Bank and the Failure of Fractional Reserve Banking

March 15, 2023With the apparent failure of Silicon Valley Bank (SVB) potentially causing a crisis in the American and even the global financial system, we will be treated to all manner of explanations, very few of which will accurately state the cause of these troubles: fractional reserve banking.

In modern banking there is little separation between warehouse and investment banking. The downside of investment banking is a potential loss of money since no investment can be a sure bet. The upside is the potential for a good return on money, the reward of taking on a degree of risk. In warehouse banking, such as personal or business checking accounts, the customer is not expecting any loss due to actions taken by the bank. The service rendered here is not expert investment advice;

Saudi Arabia’s Quandary: The End of the Petrodollar

March 9, 2023As the Biden administration continues to inflate the dollar, other nations are questioning the existence of the petrodollar.

Original Article: "Saudi Arabia’s Quandary: The End of the Petrodollar"

This Audio Mises Wire is generously sponsored by Christopher Condon.

[embedded content]

Tags: Featured,newsletter

Read More »Saudi Arabia’s Quandary: The End of the Petrodollar

March 2, 2023In 1971 Richard Nixon took the US off the last feeble vestiges of the gold standard, otherwise known as the Bretton Woods Agreement. That system had been a bizarre gold-dollar hybrid where the dollar was the world reserve currency but the US agreed to keep the dollar backed by gold. Henry Hazlitt’s book From Bretton Woods to World Inflation explains the consequences of this situation well.

The end of this system left a vacuum at the heart of world financial affairs, one that needed to be filled quickly. The dollar, now unmoored by gold, remained the default currency for international trade, but without the confidence derived from its former gold backing, the US needed to bolster its credibility lest other more enticing options appeared to displace the dollar’s

Seeing the Student Loan Crisis as a Form of Boom and Bust

September 27, 2022Sorry, I’ve looked everywhere but I can’t find the page you’re looking for.

If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page:

Search

Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dmacleod+seeing+student+loan+crisis+form+boom+bust …

Read More »Inflation, the Price Level, and Economic Growth: Everything the Elites Tell You about It Is Wrong

September 11, 2022Fundamentally, inflation is fraud. The central government or bank printing more money lessens the value of the money already in circulation. A truckload of sand isn’t particularly valuable in Saudi Arabia. An increased supply of money means ultimately that prices denominated in that money will go up. Unless you are the one to receive that new money at its point of entry, and thus keep pace with the inflation, the real value of your money holdings will go down.

So, in essence the government has taken wealth from you, and offered nothing in return, except the vague promise that the inflation will grow the economy, from which you will subsequently benefit. As we will show in this article, that is a false promise that has never once worked, and there is plentiful