The Wrong Approach This question is no longer moot. As the world moves inexorably towards the use of metallic money, interest on gold and silver will return with it. This raises an important question. Which interest rate will be higher? It’s instructive to explore a wrong, but popular, view. I call it the purchasing power paradigm. In this view, the value of money — its purchasing power —is 1/P (where P is the price level). Inflation is the rate of decline of purchasing power. . American economist Irving Fisher, of “permanent plateau” fame. He inter alia came up with the “quantity theory of money” and the infamous “equation of exchange” (as Hayek once remarked, every student of economics should know about these, and then immediately forget about them again; we know exactly what he meant to convey…). Fisher was quite the busybody. Like so many economists of his time, he became fascinated by the possibility to collate statistics and “measure” things in the economy. We have to thank him for index numbers like CPI as well, and it is probably fair to say that Fisher is the bedrock on which much of US mainstream economics rests (only things he was right about are rejected). In the early 20th century the erroneous idea began to take hold that economics should become more akin to the natural sciences.

Topics:

Keith Weiner considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Wrong Approach

This question is no longer moot. As the world moves inexorably towards the use of metallic money, interest on gold and silver will return with it. This raises an important question.

Which interest rate will be higher?

It’s instructive to explore a wrong, but popular, view. I call it the purchasing power paradigm. In this view, the value of money — its purchasing power —is 1/P (where P is the price level). Inflation is the rate of decline of purchasing power.

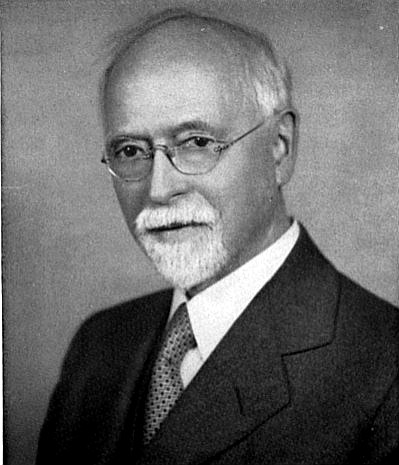

American economist Irving Fisher, of “permanent plateau” fame. He inter alia came up with the “quantity theory of money” and the infamous “equation of exchange” (as Hayek once remarked, every student of economics should know about these, and then immediately forget about them again; we know exactly what he meant to convey…). Fisher was quite the busybody. Like so many economists of his time, he became fascinated by the possibility to collate statistics and “measure” things in the economy. We have to thank him for index numbers like CPI as well, and it is probably fair to say that Fisher is the bedrock on which much of US mainstream economics rests (only things he was right about are rejected). In the early 20th century the erroneous idea began to take hold that economics should become more akin to the natural sciences. The data of economic history (i.e., statistics), would so the speak provide the numerical wherewithal to put some flesh on equilibrium equations previously only used as theoretical constructs which were understood not to apply to the real world of constant change. Why did economists so readily fall for this methodological lunacy? It was yet another momentous error – the growing belief that the economy had to be steered, or somehow centrally planned by “wise men”. No doubt tempting for those imagining themselves to be among the planners, and a catastrophe for the rest of us. [PT]

This view treats the quantity of goods you can buy as intrinsic to the money itself. This is a mistake, and it leads to a false theory of interest. Before I can present this wrong theory, let me define some terms.

The Nominal Interest Rate means the rate at which lenders lend and borrowers borrow in the market. The Real Interest Rate is the Nominal Interest Rate – inflation. Notice the switcheroo. The actual rate charged by actual lenders to actual borrowers is dismissed as merely nominal. A fictitious rate which is not used in any transactions is elevated to the status of real. Got that?

The theory asserts that interest is determined by inflation, that is, real interest > 0. With nominal rates below zero in Europe and elsewhere, this view is tempting and convenient.

According to this view, which metal has the higher interest rate comes down to which will have a faster-rising purchasing power. Most people would say silver, especially when silver is so cheap compared to gold by a long-term historical perspective.

Suppose silver’s purchasing power rises at 5% per annum (i.e. deflation) over the long run, then a nominal interest rate of 2% gives a real rate of 7%. If gold’s purchasing power is rising at only 3%, then its nominal rate must be 4%, if both metals have the same real rate.

First, and it should be obvious that, no one knows how prices will change in the future. Anyone who knew could make billions trading commodities futures. In any case, prices may change, but that is not the measure of the value of money. Consumer prices have many non-monetary forces pushing them up (such as regulations and taxes) and down (such as improved manufacturing efficiency). At best, prices are a weak proxy for the value of a falling paper currency.

I don’t take the purchasing power approach.

Monetary Science

Instead, to determine which rate will be higher, let’s look at the incentives that encourage action. Everyone who owns metal will face the choice: to hoard it or to lend it.

In general, we know that if interest is greater than their time preference, people will lend. But that does not help us predict which metal will have the higher rate. For that, we must look at factors that differ between them.

For example, there is a cost to store precious metals. Since silver is about half as dense as gold, an ounce of silver is almost twice as bulky. And that ounce has about 1/75 as much value as an ounce of gold. This means to hold the same value in silver you need 150 times the volume of gold. An iPhone (the small size) made of gold is worth as much as two and half bread loaves made of silver. No wonder why storing silver is typically more expensive.

If silver storage costs you 0.75%, and gold is 0.5%, then there is a 0.25% spread in storage costs. Lending silver is a net gain for you, compared to lending gold at the same rate. This is an actionable spread (unlike the so called real rate)—an incentive to lend silver in preference to gold.

There are other differences between the metals, such as marginal utility. Economists had long struggled with a dilemma. Water is important to human life, but diamonds are not, so why is the price of a diamond much higher? If you are thirsty in a desert, the first gallon of water is worth a high price.

The second is worth less. By the third or fourth, you are not willing to pay anything. The reason is that you use the first gallon for drinking. The second is a spare. The third is to wash yourself. The fourth is maybe to wash your clothes. Can you think of what to do with a fifth gallon?

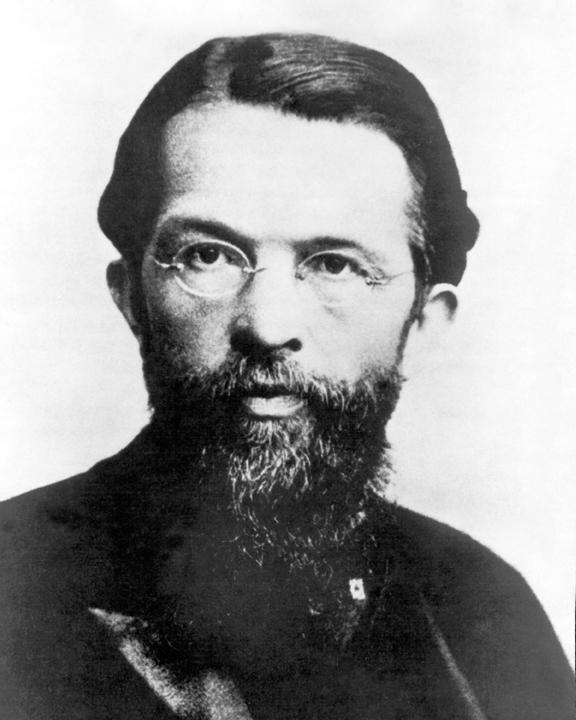

Carl Menger – this is actually someone to learn from. Menger, Jevons and Walras discovered marginal utility independently and simultaneously (Jevons and Menger published in 1871, Walras in 1874, but it is well-established that he had thought of it independently). They finally resolved the greatest problem classical economists had failed to come to grips with, namely the theory of value. Funny enough, Karl Marx published “Das Kapital” in 1873 and his economic theorizing was still based on the erroneous labor theory of value (the Marxists then decided to stick with it, presumably for ideological reasons). [PT]

Economist Carl Menger resolved the dilemma with his discovery of the principle of marginal utility. Marginal utility refers to the value of the next quantity of the good in relation to the previous. Marginal utility declines, because when the higher needs are satisfied, the next unit of the good goes to a lower need.

Water is so abundant, that at the margin its value is nearly zero. People use water to clean their driveways. Large, high-quality diamonds are not so abundant. They are used only for engagement rings and other important jewelry pieces.

Each kind of good has a different marginal utility. For food, it’s low because food perishes. For many durable goods, it’s higher because they can be stored until needed.

Over thousands of years, the market ranked all goods by marginal utility. It determined that the highest marginal utility belongs to gold. Gold is not consumed, and virtually all gold ever mined is still in human hands. Even today, gold mining continues and the market happily absorbs all that can be produced. Silver is second.

People value the last ounce of gold as much as the first (or nearly as much). Whereas wiith silver, the last ounce matters a bit less. People may be willing to part with some silver more easily. By this assessment, one might expect people to prefer to lend silver, and therefore gold should have the higher interest rate.

However, there are other factors to consider.

Hoarding and Speculation

For the next one, it may be easier by starting with a physical analogy. A metal ball is tied to the left side of frame by a piece of string. You try to pull it to the right with a magnet. Physics teaches us that it will not move, unless the force of the magnet is greater than the strength of the string.

Applying this analogy to money, the left side is hoarding. Metal is held there by the propensity to hoard. People have hoarded since before recorded history, because they must plan for the future, especially senescence and retirement. They hoard today because they don’t know what a dollar will be worth in 10 or 30 years. The force pulling metal out of hoards is interest. Lending can only occur if Interest is high enough.

This sounds a lot like our discussion of time preference. Interest must be higher, or else there is no lending. However, time preference is not about a metal, and so it tells us nothing about which will have the higher rate.

It also sounds a bit like our discussion of marginal utility. If the propensity to hoard were just the effect of marginal utility — if people hoarded simply because they valued the next ounce of gold as much as the previous — then the answer would be simple. Gold would have the higher interest rate, as it has the higher marginal utility.

However, the propensity to hoard is something else. To understand, we must ask something that few have asked.

Why are there two monetary metals?

Gold and silver both continue to enjoy monetary demand (it does not matter that governments have officially “demonetized” precious metals – it is still monetary demand that drives their prices). [PT]

Photo credit: Mark Herpel

This is an important question. The answer is not at all obvious. Money has a network effect. The more people who use a form of money, the more its value increases. Think of eBay. All the sellers go there because that’s where the buyers are. And all the buyers go there because that’s where all the stuff is offered for sale.

The network effect makes it more puzzling that we have two different monies. In other cases when two different networks compete, one winner eventually emerges. For example, alternating current beat direct current for use in the electric grid. More recently, Internet protocol beat token ring for use in the public data network.

Different Groups of Users

Yet, over thousands of years, gold has not displaced silver. The reason is that gold and silver do not directly compete. They perform different functions. Both are heavy and shiny metals. Both are resistant to tarnish, and they’re good conductors of heat and electricity. But their physical similarity has misdirected attention from their separate roles.

Gold was selected by traders as the best money to carry large values, especially over long distances. Before gold, they used cattle, because cows move under their own power. Gold does not move itself, but its value density is so high that you can easily carry a fortune in your pocket.

Today, gold can be moved anywhere in the world in days. The entire globe is effectively the trading region for gold. This means that gold is not subject to local gluts or shortages. Gold supply and demand are quickly smoothed out over the entire world. This helps makes gold the most liquid commodity.

Silver was chosen by wage-earners, not for carrying large value over distance, but to carry value over long periods of time. Before they used silver, they used salt. Salt is not perishable, and it is accessible to even unskilled laborers. Workers need a way to accumulate small amounts of value every month, and store it until needed to buy groceries in retirement.

Gold does not work as well for this purpose. An ounce of gold is far too much for most people to buy weekly or even monthly. In smaller sizes, you pay a high premium which will be lost when you sell. Silver offers a better deal for small savers. Silver is the most hoardable commodity. Gold tends to be owned by wealthier people. It is likely that a larger number of people have smaller amounts of silver.

The wage-earner who has a modest stack of silver coins does not need interest so much as he needs security. Lending and interest are for people who have already covered their need for security. The wealthy, by contrast, will decide to lend their gold purely as a financial decision. To them, it may be no different than running their dollar investments.

Silver’s greater hoardability suggests that much of this metal is not available for lending, and what is offered will demand a higher interest rate.

Silver is also the metal of choice for speculators. We might coin the term speculability (not a real word). Speculators are betting on a 25% gain in a few months, or a 2,500% gain in a few years. As a trader, the speculator is ready to sell quickly. While speculators may appreciate interest, they may not want to commit the metal for the time necessary to earn it.

Silver’s higher speculability, like its hoardability, encourages us to think that silver will command the higher interest rate.

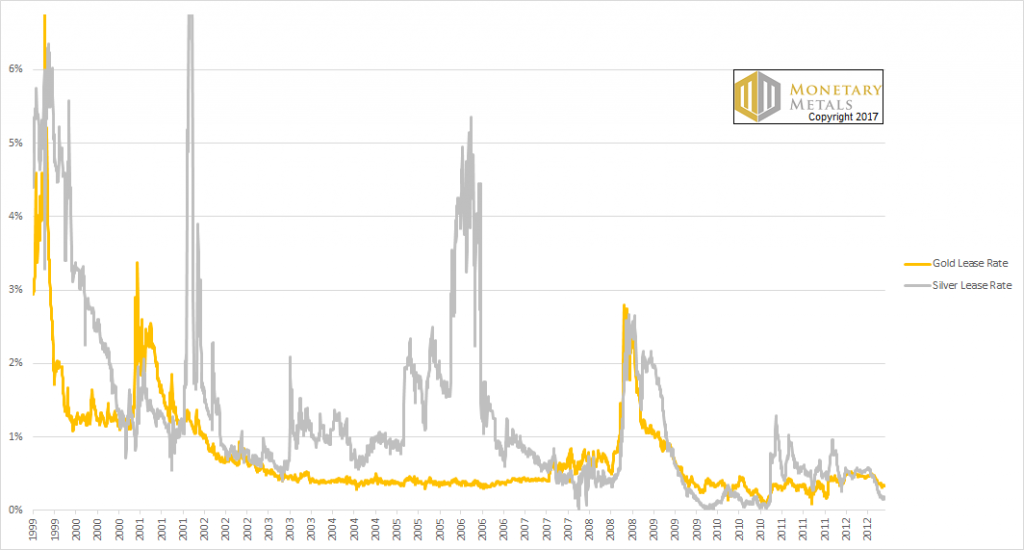

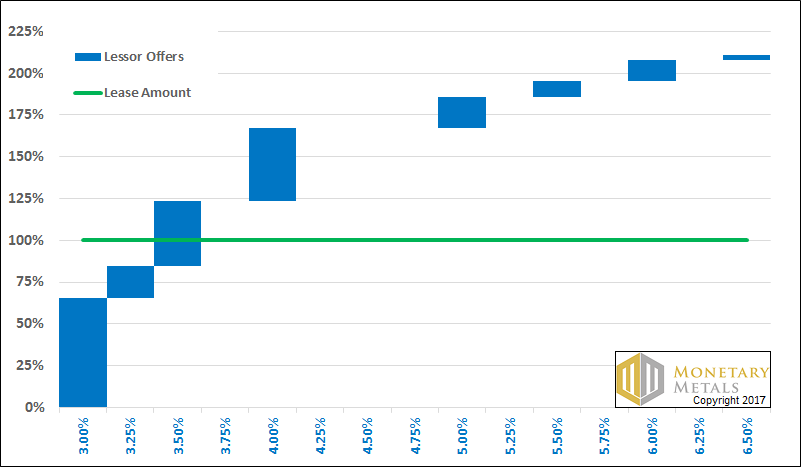

Buying Metal to Earn InterestThis leads to an opposing factor. The world is inverting now. For many decades, there had been interest on paper currencies, but not on money. But now, interest in paper is vanishing, while it emerges in money. Some investors will be drawn to metal solely for the interest. If they can buy either gold or silver to earn interest, most will choose gold. It’s the senior metal, less volatile, and less ambiguous between industrial consumption and monetary uses. So far, we have looked at lender supply of metal. What of borrower demand? I think it’s premature to try to predict this. A business should borrow the money which it earns as revenue. For example, a gold mine should borrow gold to expand and a silver mine should borrow silver. The question of which metal will have higher demand for borrowing is simply which metal will be more used as a medium of exchange. Circulation is itself a function of interest rate. At zero interest, metal cannot circulate. It is for hoarding only. Interest draws it out of hoards. This is a feedback loop, a non-linear system. Finally, let’s look at some data which may help inform our analysis. Today, under paper currency, there is a market for what is called leasing (I have written three papers discussing this market — the links to Part I Part II and Part III are here — arguing why one should be careful not to conclude too much from it, especially Part II). Here is a graph showing the gold and silver lease rates (six-month maturity). It runs from July 26, 1999 through November 2, 2012, or 3,356 days, the period when the London Bullion Market Association quoted the silver lease rate. |

|

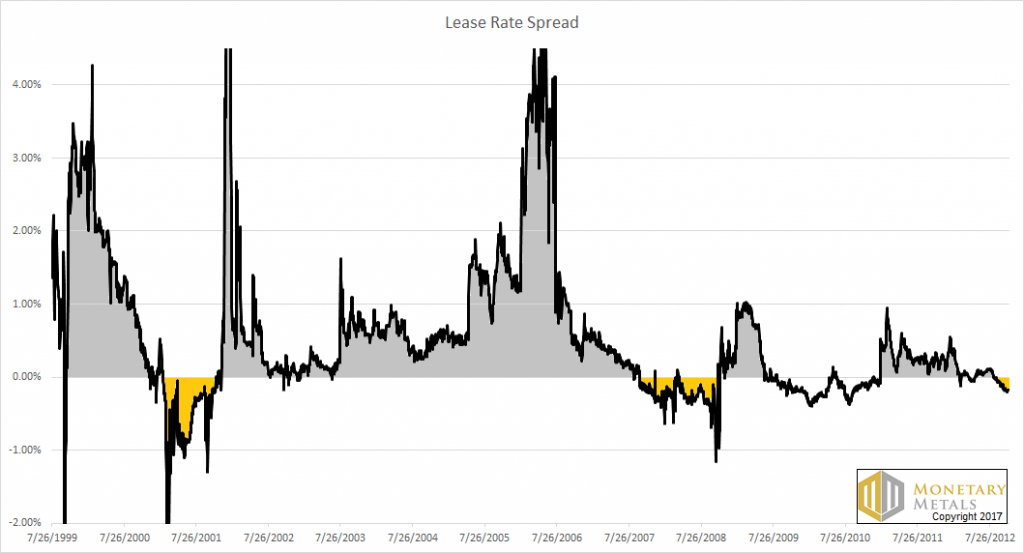

| The silver lease rate is higher most of the time. Here is a graph of the spread, to show this more clearly.The silver lease rate was higher than the gold lease rate on 71% of trading days. And when the silver rate was higher, it was about 0.9% higher on average, whereas when gold was higher, it was only about 0.3% higher.

It is worth noting that the silver lease rate is much more volatile than that of gold. This is due to several reasons, but the most important is that silver is less liquid. |

Silver Lease Rate, July 1999 - July 2013 |

My OpinionThe above is my framework for thinking about this topic. I welcome criticism of any errors I may have made. But errors aside, what I tried to present above is not opinion but science. However, an article like this demands that I offer my opinion. So here it goes, I will stick my neck out. I believe that silver will have the higher interest rate. The primary reason is that silver is more hoardable, and hence it will require greater compensation to incentivize people to give up their silver. I must also say that I already see dollar investors buying metal just to earn interest. They are buying gold. Let me take this opportunity to add one sobering thought. While I believe that my study of monetary science qualifies me more than most people to predict the interest rate, central planning always fails. One reason is that no one—no matter how qualified—knows what everyone wants. I would never want to be put in a position to dictate what interest rates people must lend gold, silver, or anything. I would refuse, as John Galt did in Atlas Shrugged, the job of Economic Dictator. It takes a market with many buyers and sellers, to set the price of anything. Including the price of borrowing money. The Crowdsourced ExperimentWhich metal should offer the higher rate—and what those rates should be—is the most important economic question of our era. The paper currencies are now in the terminal stage of failure, with some already dead (Zimbabwe), some in their death throes (Venezuela), and some showing advanced signs of cancer (Switzerland and Japan). The dollar is the least ill paper currency in hospice. My company is conducting an experiment. We are crowdsourcing the answer to these questions, and publishing our findings. We just closed a gold deal. Here is the graph showing the interest rates offered by the investors (horizontal axis), and amount of gold offered (vertical). The market is nascent. However, notice that there was a pretty tight grouping of offers from 3% to 3.5%, with significant additional gold offered at 4%. We may find that I am correct in predicting that silver will have the higher rate. We may find I am totally wrong. Maybe both metals will even have the same rate (though I doubt that, it would be like finding two ropes from different manufacturers had the same strength). Whether I am right or wrong about the gold-silver interest rate spread doesn’t matter. What matters is that this is the moment of a monetary renaissance. It’s an exciting time. I encourage everyone to tune in, and follow our results as they emerge. |

Lessor Offers And Lease Amount |

Tags: Featured,newsletter,Precious Metals