(originally published on Seeking Alpha at end of October 2016) The current article will take a closer look to the incredible rise of the Swiss National Bank stock and suggest why taking a short position could be the right trade at this level. The Swiss Central Bank: Mandate and Monetary Policy According to the Swiss Federal Constitution (Art. 99) the Swiss Central Bank is an independent institution with the mandate to conduct the monetary policy in Switzerland by ensuring price stability, while taking into account the economic growth. Capital Structure Different from many other Central Banks, the SNB is a private company with a nominal Shareholder Capital of CHF 25mln, co-owned by public and private entities. The Shareholder capital is based on 100’000 shares with a value of CHF 250 and it is listed in the Swiss Stock Exchange (OTCPK:SWZNF). According to SNB website, at the end of 2014 the shares were divided as follow: Swiss Cantons and Public Institutions were holding 55% Swiss Cantons’ Banks were holding 19% Private Entities (Swiss people or foreigners) were holding 26% According to the National Bank Act (2003), the voting right iscapped to 100 shares for private entities and the dividend can be maximum 6% of the shares nominal value (e.g. CHF 15).

Topics:

Felk considers the following as important: English Posts on SNB, Featured, newslettersent, Swiss National Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

(originally published on Seeking Alpha at end of October 2016)

The current article will take a closer look to the incredible rise of the Swiss National Bank stock and suggest why taking a short position could be the right trade at this level.

The Swiss Central Bank: Mandate and Monetary Policy

According to the Swiss Federal Constitution (Art. 99) the Swiss Central Bank is an independent institution with the mandate to conduct the monetary policy in Switzerland by ensuring price stability, while taking into account the economic growth.

Capital Structure

Different from many other Central Banks, the SNB is a private company with a nominal Shareholder Capital of CHF 25mln, co-owned by public and private entities. The Shareholder capital is based on 100’000 shares with a value of CHF 250 and it is listed in the Swiss Stock Exchange (OTCPK:SWZNF).

According to SNB website, at the end of 2014 the shares were divided as follow:

- Swiss Cantons and Public Institutions were holding 55%

- Swiss Cantons’ Banks were holding 19%

- Private Entities (Swiss people or foreigners) were holding 26%

According to the National Bank Act (2003), the voting right iscapped to 100 shares for private entities and the dividend can be maximum 6% of the shares nominal value (e.g. CHF 15). These two rules limit the rights of private investors, capping the capital distribution and the impact on the Bank’s policy. Giving the opportunity to private citizens to be Central Bank’s shareholders, the Swiss Government wanted to anchor the Bank to the Swiss citizens’ culture and give them the opportunity to be part of an institutional entity.

The underlying decision by Swiss Government of having a private central bank is to reinforce the Bank’s independence on monetary issues, limiting any type of political intervention.

Monetary Policy and tools

The SNB monetary policy is decided by the board. The main objective is to conduct a monetary policy to ensuring price stability with a target inflation below of 2%.

The Bank main monetary tool is the repo transaction (cash against collateral), which is based on the decision of the deposit interest rate, in order to influence the 3-month CHF-Libor. However, the SNB has additional tools to reach its mandate, which take the form of foreign currency investments and open market operations.

Currently, the SNB has set the deposit rate at -0.75%, and it is actively investing in the financial markets to avoid massive Swiss Franc appreciation.

In 2011, the SNB intervened in the FX market by pegging the cross EURCHF to 1.2, stopping the appreciation trend of the Swiss Franc against the Euro. The policy was aiming to sustain the price stability and help Swiss exporters. However, the policy failed and the SNB removed the peg in January 2015.

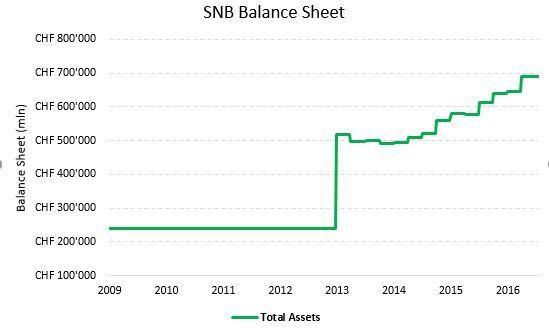

Since then, the SNB continued to intervene in the financial markets, mainly through FX operations and by investing in foreign financial assets. According to FRED Economic Data, the current balance sheet level is approx. CHF 700bln, which is almost 100% of the current Swiss GDP. Compared to the other major CBs, the figure is definitely higher, as the FED balance sheet is approx. at 25%, the ECB at 25% and the BoJ at 70% of GDP.

| The Bank balance sheet is managed according to the National Bank Act, which declares that a part of the Bank’s reserves must be held as a form of gold investments (6% at the of 2015). The Bank manages the rest of its reserves through bond (75%) and equity (16%) investments. The Bond portfolio has securities of foreign and Swiss institutions, whilst the equity portfolio buys passively shares in small, mid, large DM and EM companies. The majority of investments are denominated in Euro (42%) and USD (32%).

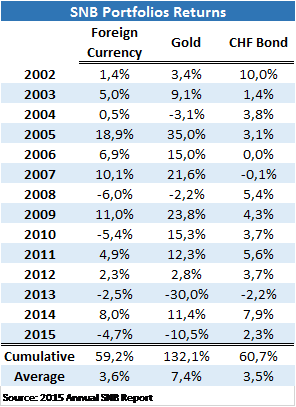

According to the 2015 Annual SNB report, the major risks are currency risk, as well as market risk for bonds and equities. The SNB can hedge the risks through derivatives and swaps, but it does not hedge the Swiss Franc, as it would cancel any type of benefits of monetary base creation. Moreover, the SNB is still subject to duration risk, as its foreign bond portfolio (CHF 500bn) had an average duration of 4 years at the end of 2015. The activity of asset management has the primary goal to post profits for to the Swiss Confederation and Cantons. Since 2002, the average performance of foreign investments was 3.6%. |

SNB Balance Sheet 2009 - 2016 |

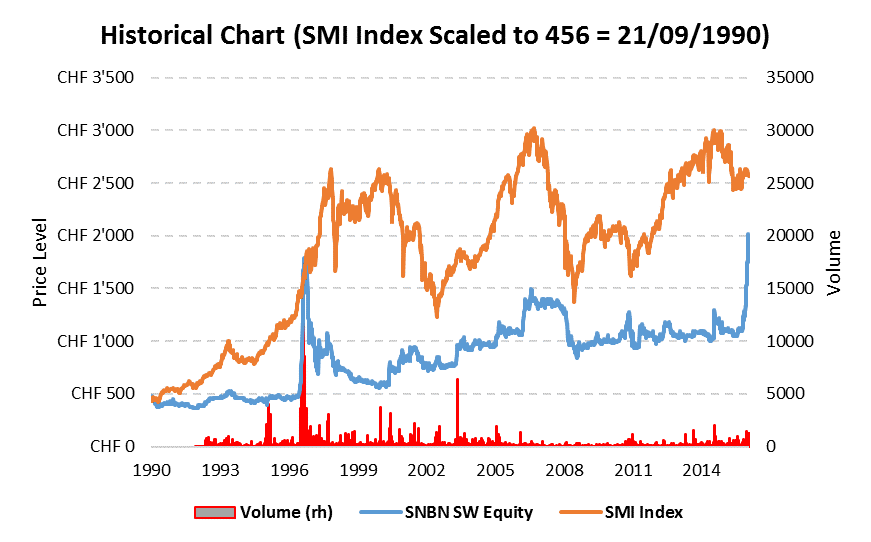

SNB Stock PriceThe previous section had the objective to describe the role of the SNB and its capital structure, in order to investigate now the exaggerated move of its stock price. The SNB’s stock price is currently trading at CHF 1775 (17th October 2016), after surging more than 62% since 1st of July 2016. This type of move is not unusual for the SNB share price, as it experienced similar movements in 1996 and 2006. In 1996, the stock repricing was driven by speculation on Bank’s gold reserves. Indeed, Bank revaluations of its gold assets created expectations of higher dividends pay-outs and probability of their distribution. Later in 2007, the SNB decided to sell a part of gold amid a change of its investment rules, and investors were expecting higher dividends given the gains in the price. However, the gold reserves were managed in behalf of the Swiss Government, which was the legal owner. Afterwards, the stock price retraced, losing the entire gain. |

Historical Chart 1990 - 2014 |

| From a technical point of view, the current surge is not supported by the volumes, which are well below historical highs. This induces that the rally has been driven by few investors aiming to increaseuselessly their share ownership and their influence on the Bank’s policies. As reported earlier in the article, the Swiss Act on the Central Bank limits the influence of private investors, making de facto any increases in shares worthless.

At the end of 2015, the Asset/Equity ratio (a proxy of investment leverage) was 10.5x, increasing sharply from 2008 level (3.7x). Such high level of leverage may pose elevated volatility in the Bank’s capital structure in case of bonds or stock market revaluations, which are currently close to all-time highs. Historically, turbulent market conditions caused negative returns on the foreign investment portfolio (-6% in 2008 and -5.4% in 2010). |

SNB Portfolios Returns 2002-2015 |

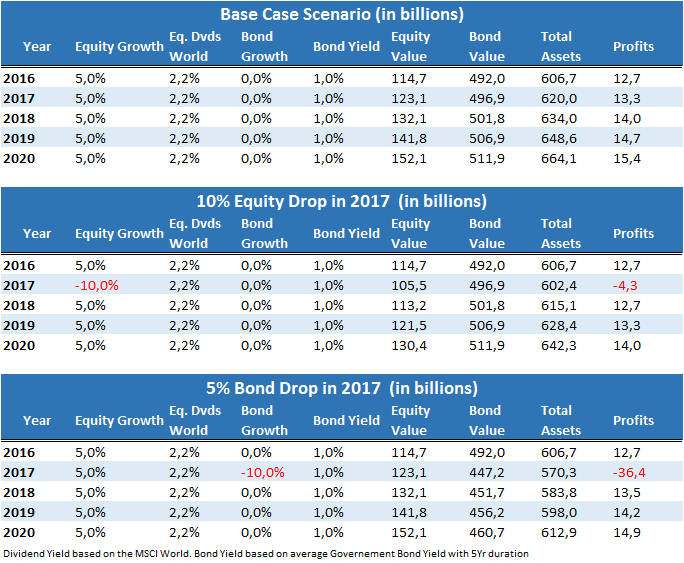

| In order to quantify the potential losses from an equity depreciation or a bond drawdown in the coming years, we compare a base case scenario (Equity=+7.2% – Bond=0.6%), with two separate negative market environments (Equity=-7.8% – Bond=0.6% and Equity=+7.2% – Bond=-4.4%). On the one hand, the SNB would continue to post strong profits and therefore distribute the capped dividends to shareholders. On the other hand, bonds could have a much stronger negative impact in case of losses as a simple -5% bond drawdown (equivalent of a 1% Yield increase) may wipe out more than CHF 11bn (-1.9% of total Assets). Although this analysis is based on simple assumptions, it clearly shows how small negative market returns could have a remarkable impact on the Bank’s profits. |

Base Case Scenario, 10% Equity Drop in 2017, 5% Bond Drop in 2017 |

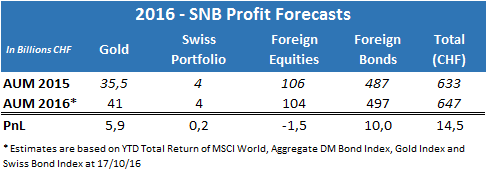

| As the SNB is a private company, we analyze the probabilities to pay the 2016 dividend to shareholders. Starting from the 2015 asset allocation, we compute the profits for the SNB positions, by taking into account securities total returns and FX effects. Based on the market closure of 17th October 2016, we denote a positive return for gold, Swiss and bond positions, whilst the equity portfolio, estimated through the MSCI World Index, is down for the year. The total PnL was close to CHF 15bn. This number is supportive for the annual dividend and therefore investors should expect a profit distribution. |

2016 - SNB Profit Forecasts |

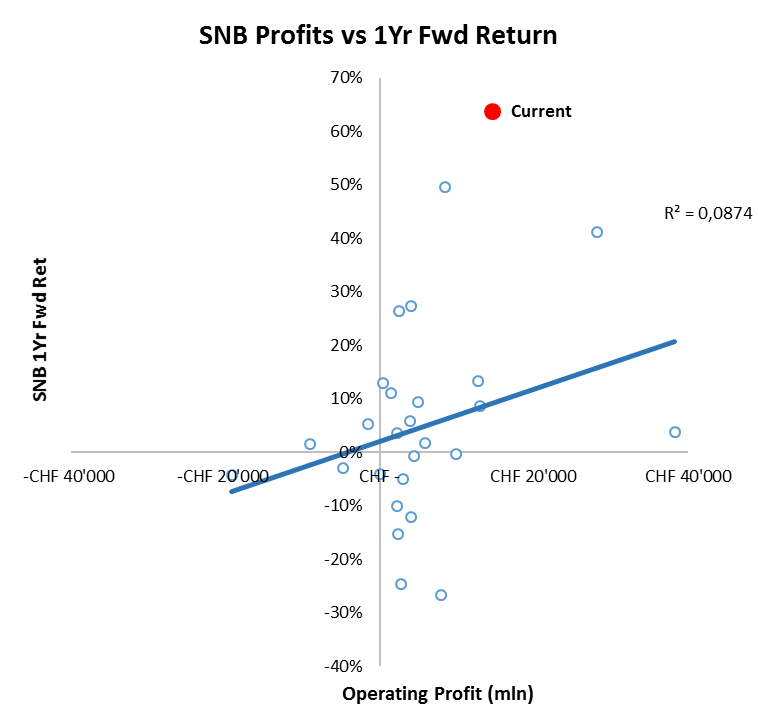

| However, we think that the current market movement (e.g. 62%) is way too high, as is showed in the SNB Profits vs 1Yr Fwd Returnchart. The analysis therefore reinforces the thesis that the stock is overvalued. |

SNB Profits vs 1Yr Fwd Return |

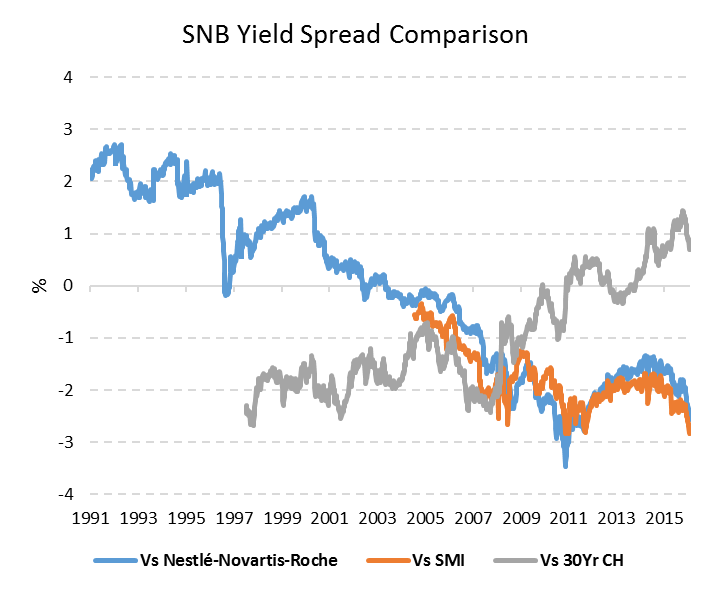

| A further check to identify the relative expensiveness of the SNB stock is a yield spread analysis with a basket of the safest Swiss stocks (Nestlé, Novartis, Roche), the SMI Index and the 30Yr Swiss Gov. Bond. By looking at the chart, we denote that the SNB dividend yield is currently lower than the yield of the selected basket of save stocks and of the SMI Index, whilst it still offers a good return compared to the Swiss 30Yr. |

SNB Yield Spread Comparison 1991-2015 |

Conclusion and Trade Idea

Based on the previous analysis, we conclude that the SNB is currently trading at an unsustainable level which makes the current yield too low for shareholders. The stock is now discounting a good profit results for the year which translates in a higher probability of paying the capped annual dividend. However, it is worth mentioning that currently the market risk in equity and bond is elevated and could cause downward pressure on SNB profitability in the near future. By running a linear regression between SNB annual profits and future stock return, we can conclude that the recent surge in share prices could be justified by an annual profit 8x higher than our PnL estimate for 2016. Moreover, the current price movement is not supported by large volumes; this feature makes any fundamentally driven explanation less compelling.

Given the arguments provided in the article, we give a sell recommendation with a target of CHF 1300 for the SNB stock price in the next 6-months. The target price implies a -26.7% return since the closure price on 17th October 2016.

Disclosure: I am/we are short SWZNF.

Tags: Featured,newslettersent,Swiss National Bank