Before any rate cut, intervention in the forex market is likely to remain the Swiss National Bank’s first line of defence to counter any appreciation of the CHF.Data published on Monday revealed that commercial banks’ sight deposits at the Swiss National Bank (SNB) rose by CHF1.7bn last week (see chart), the largest weekly increase since May 2017. The amount suggests the SNB intervened in the FX market, probably ahead of the ECB’s meeting last Thursday.Weekly releases of commercial banks’ sight deposits at the SNB will be key to watch as they could be a precursor to rate cuts. When the SNB lowered its policy rate to -0.25% in December 2014 and then removed the exchange rate floor and lowered the policy rate further (to -0.75%) a month later, this was after massive intervention in the FX

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss currency intervention, Swiss currency manipulator, Swiss National Bank, Swiss rate cuts

This could be interesting, too:

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes China’s Politburo Validates and Extends Pivot while the US Dollar Sees Yesterday’s Gains Pared

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

Before any rate cut, intervention in the forex market is likely to remain the Swiss National Bank’s first line of defence to counter any appreciation of the CHF.

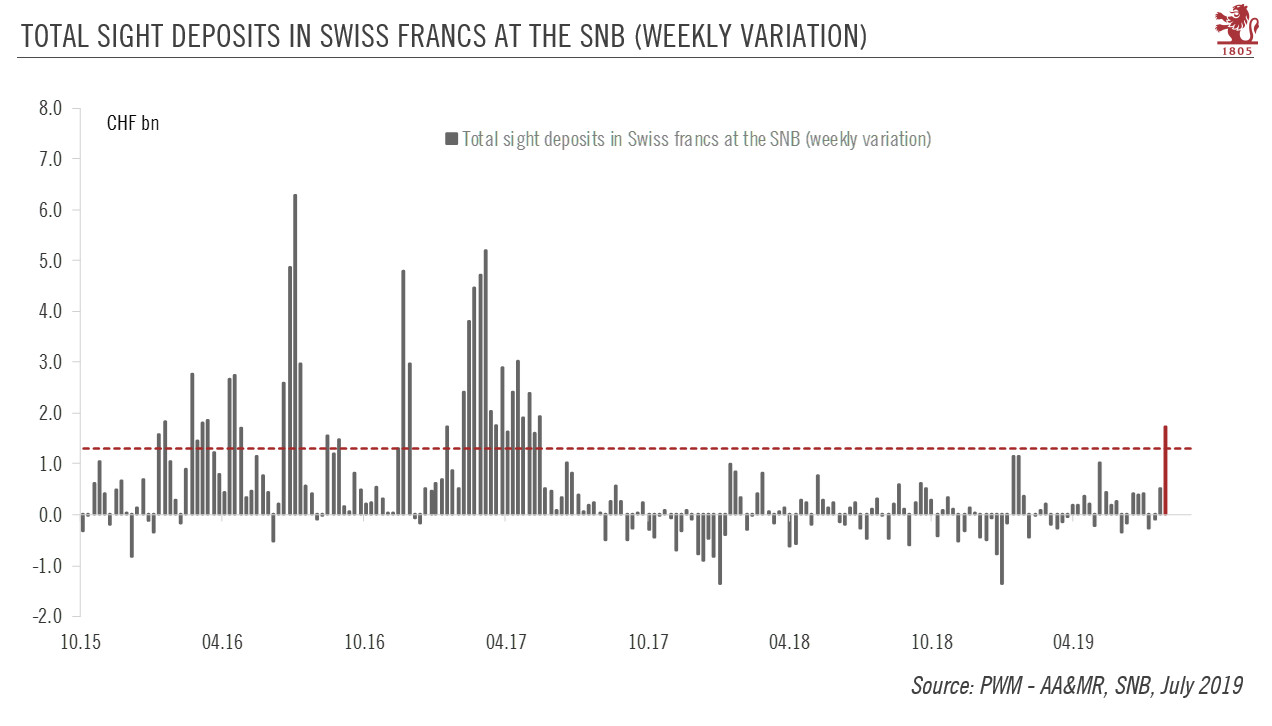

Data published on Monday revealed that commercial banks’ sight deposits at the Swiss National Bank (SNB) rose by CHF1.7bn last week (see chart), the largest weekly increase since May 2017. The amount suggests the SNB intervened in the FX market, probably ahead of the ECB’s meeting last Thursday.

Weekly releases of commercial banks’ sight deposits at the SNB will be key to watch as they could be a precursor to rate cuts. When the SNB lowered its policy rate to -0.25% in December 2014 and then removed the exchange rate floor and lowered the policy rate further (to -0.75%) a month later, this was after massive intervention in the FX market in the weeks before. Nevertheless, a rate cut is still not our baseline scenario.

SNB officials have emphasized the importance of the interest rate differential (mainly versus the euro area) for the exchange rate and thus the policy outlook. The SNB’s policy rate differential with the European Central Bank’s (ECB) deposit facility rate now stands at 35bp, below the 50bp in 2015 when the SNB lowered its interest rates to -0.75%. However, we believe that the SNB will be reluctant to cut rates before the ECB or in direct response to any ECB easing, especially if the upcoming ECB rate cut in September is only 10 basis points (bps), as per our baseline scenario. That said, a bigger easing package from the ECB cannot be entirely ruled out. In that event, should the CHF come under excessive upward pressure, our best guess is that the SNB would cut the interest rate on sight deposits by 25 bps, bringing it down to -1.0%. To ease the impact on the banking sector, the exemption thresholds for banks’ sight deposits with the SNB could be modified to limit the share charged at -1.00%.

Switzerland was dropped from the list of countries being monitored for currency manipulation by the US Treasury in May. However, Switzerland’s goods trade surplus with the US has been increasing, making it likely that it will be put back on the monitoring list in the autumn. However, this prospect is unlikely to alter SNB monetary policy or prevent its FX market interventions.