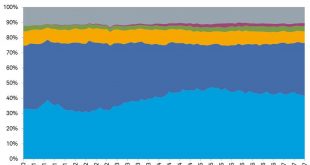

With the first half of 2018 now behind us, it’s an opportune time to look at whats been happening in the Chinese Gold Market. As a reminder, China is the largest gold producer in the world, the largest gold importer in the world, and China’s Shanghai Gold Exchange is the largest physical gold exchange in the world. For various reasons such as cross-border trade rules, VAT rules and deep liquidity, nearly all physical...

Read More »China’s Secret Gold Supplier Is Singapore

Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future. Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking...

Read More »China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day. The Chinese appear to be price sensitive regarding gold, as was mentioned in the most recent World Gold Council Demand Trends report, and can also be...

Read More »The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece...

Read More »An update on SGE Vault Withdrawals and SGE Price Premiums

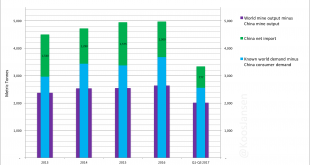

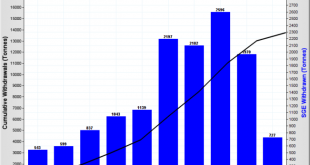

In 2016, withdrawals of gold from the Shanghai Gold Exchange totalled 1970 tonnes, the 4th highest annual total on record. This was 24% less than SGE gold withdrawals recorded in 2015, which reached a cumulative 2596 tonnes (See Koos Jansen’s 6 January 2017 blog at BullionStar “How The West Has Been Selling Gold Into A Black Hole” for more details of the 2016 withdrawals). SGE gold withdrawals are an important metric...

Read More »How The West Has Been Selling Gold Into A Black Hole

Kindly be advised to have read my posts The Mechanics Of The Chinese Domestic Gold Market and The Great Physical Gold Supply & Demand Illusion before continuing. In December 2016 Chinese wholesale gold demand, measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), accounted for 196 tonnes, down 9 % from November. December was still a strong month for SGE withdrawals due to the fact the gold...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org