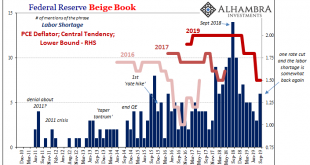

Federal Reserve policymakers appear to have grown more confident in their more optimistic assessment of the domestic situation. Since cutting the benchmark federal funds range by 25 bps on July 31, in speeches and in other ways Chairman Jay Powell and his group have taken on a more “hawkish” tilt. This isn’t all the way back to last year’s rate hikes, still a pronounced difference from a few months ago. The common forecast relies entirely on the subjective...

Read More »US Industrial Downturn: What If Oil and Inventory Join It?

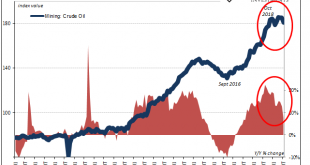

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one. The only place where there was a truly robust trend was the oil patch. Since the last crash a few years ago,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org