Overview: The Year of the Rat is off to an inauspicious start as apparently a fly rat (a bat) virus has jumped to humans. China’s markets re-opening amid much fanfare, and the Shanghai Composite dropped 7.7%, which is about what the futures in Singapore had anticipated. Several other markets in the region (Japan’s Nikkei, Australia, Singapore, Taiwan, and Thailand) fell by more than 1%. However, European and US shares are edging higher, and other measures of...

Read More »Carney Gets Ahead of Market Expectations; Sterling Slumps, Gilts Soar

Summary: BOE cuts rates and expands QE. Door is open to more easing. Sterling stabilizes after selling off 2 cents. Sterling has slumped two cents in the wake of the Bank of England’s announcement. It cut the base rate 25 bp and announced a resumption of its asset purchase program. It will buy GBP60 bln of Gilts and added corporate bonds to its purchase plan, which will be completed over the next six...

Read More »FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

Swiss Franc The euro Swiss remains at relatively low levels, compared to the ones achieved in the recent risk-on enviornment. Click to enlarge. It is a bizarre turn of events. Just like the Game of Throne’s Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered...

Read More »Squaring the Circle: Can Article 7 be Used to Force Article 50?

Summary: Article 7 would suspend the UK’s EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what “is” means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not. Due to an unlikely string of events, the UK had sorted out its government more than two months...

Read More »FX Weekly Preview: Sources of Movement

Summary: Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins. Investors are under siege. A growing proportion of bonds in Europe and Japan offer negative yields. The German and Japanese curves are negative out 15-years, while one cannot find a positive yield among any tenor of Swiss government bonds. Despite a string of...

Read More »Is Carney the Sole Adult in UK’s Political Morass?

Summary Sterling has fallen to $1.3050. Two real estate funds have suspended trading (liquidation). Constitutional crisis over who has authority to trigger Article 50 may have begun. Sterling is continuing to move lower. It has tested the $1.3050 area in the North American morning, having been under pressure through the Asian session and the European morning. That the UK economy is slowing down, materially, as...

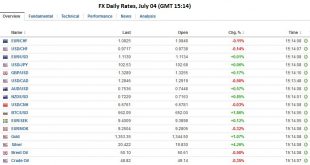

Read More »FX Daily, July 04: Four Things that Happened on the Anniversary of the Original Brexit

Summary Inflation expectations fall in Japan. UK construction PMI fell sharply before Brexit. The Australian dollar recovers from the dip as investors await more results. It is not clear that Brexit has sparked a wave of nationalism or anti-EU sentiment. FX Rates Monday, while Americans were celebrating the original Brexit, the US dollar drifted lower. The Australian dollar fully recovered from electoral...

Read More »FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Summary Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act. There have been two developments that are shaping investment climate. The first was the dramatic rally in equity markets last week, with many recovering nearly all that was lost on the Brexit...

Read More »FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday’s; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today. Turnaround Tuesday after such dramatic price action over the last two sessions has the feel of the proverbial dead cat bounce. Brexit There has...

Read More »Great Graphic: Sterling Monthly Chart and Outlook

Summary Sterling’s losses are not simply a product of thin liquidity or panic. Both main political parties are in disarray just when strong leadership is needed. The rough projection pre-vote of what could happen on Brexit suggests $1.20-$!.2750. This Great Graphic shows sterling’s monthly performance since 1971, according to Bloomberg data. There have been several powerful trends. The rally from $1.40 to $1.50...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org