Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

Read More »Weekly Speculative Positions: Bottom-Picking Sterling, Swiss Franc Even More Net Short

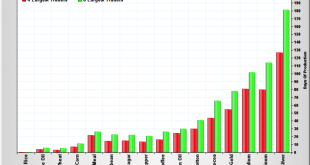

Comment on Swiss Franc by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Swiss Franc and Euro In both euro and Swiss Franc, the net short position expanded. Speculators are now net short the euro with 124K contracts and net short Swiss Franc by 18.7K contracts against the US Dollar. Register for an OANDA forex trading...

Read More »Weekly Speculative Positions: More Bearish Euros and CHF, Less Bullish the Yen

With the strong ISM non-manufacturing PMI last week, long positions on the dollar are increasing, while speculators increase their euro and Swiss Franc shorts. CHF net shorts increased to 9.4 K positions. That the euro has depreciated against CHF, is possibly caused by real, non-speculative money into CHF, i.e. money in the form of cash and stock purchases. We will get more information tomorrow when the SNB sight...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org