Most Long-Term Trends Have Not Changed

A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime. The rest of Asia responded to the initial outbreak better than the Chinese (and most everywhere else we now know) and generally mitigated the health effects, if not the economic ones. China opened back up first and the rest of Asia has followed suit. Economic recovery in China, appears at least, to be accelerating. The rest of Asia is also recovering but the depth of the downturn was not as great and so neither is the recovery pace.

Articles by Joseph Y. Calhoun III

Monthly Macro Monitor – June 2020

June 19, 2020The stock market has recovered most of its losses from the March COVID-19 induced sell-off and the enthusiasm with which stocks are being bought – and sold but mostly bought – could lead one to believe that the crisis is over, that the economy has completely or nearly completely recovered. Unfortunately, other markets do not support that notion nor does the available economic data. Of course, markets look forward and there is the possibility that stock market buyers are privy to knowledge about the future that bond traders are not. Sure.

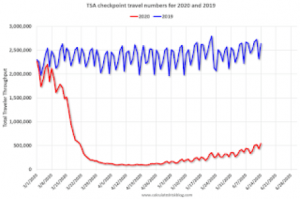

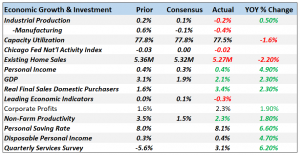

There is no doubt that economic activity is recovering from its worst levels. We can see that in numerous official and anecdotal reports. Because the official economic data is so delayed, investors have turned to new,

Monthly Macro Monitor: Does Anyone Not Know About The Yield Curve?

August 26, 2019The yield curve’s inverted! The yield curve’s inverted! That was the news I awoke to last Wednesday on CNBC as the 10 year Treasury note yield dipped below the 2 year yield for the first time since 2007. That’s the sign everyone has been waiting for, the definitive recession signal that says get out while the getting is good. And that’s exactly what investors did all day long, the Dow ultimately surrendering 800 points on the day. I don’t remember anyone on CNBC mentioning it – although surely they must have – but by the end of the day the curve actually ended up back in positive territory, the inversion lasting less than a day. So, never mind. Maybe.

Of course, the 10/2 curve is only a small slice of the yield curve and other parts have been inverted for some