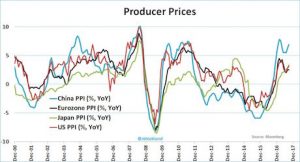

I believe 2018 will be the year inflation arrives.

The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

All told, in 2017 alone, these Central Banks will printed over a $1.5 trillion in new money and funneled it into the financial system. This is an all-time record, representing even more money printing than what took place in 2008 when the whole world was in the grips of the worst crisis in 80 years!

And it has finally unleashed the much sought after inflation.

Articles by Graham Summers

Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

July 2, 2016Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are “more negative than others”, because investors expect a slow appreciation of the Swiss franc.

Sometimes it’s critical to look clearly at the big picture.

The big picture is that the financial world has allocated capital… trillions of dollars of capital, based on Central Banks trying to corner the bond market.

In the current debt-based monetary system, sovereign bonds are the bedrock of finance.

Every other asset under the sun trades based on where sovereign bonds (like US Treasuries or German bunds) are trading.

So if Central Banks are manipulating bonds via QE purchases and ZIRP/NIRP, the entire financial system begins to misprice risk.

Consider Switzerland today.Swiss sovereign bonds are currently posting negative yields as far out as 30 years.

Pay the Swiss Government for owning their bonds

Put another way, the bond market is priced in such a way that investors are willing to pay the government of Switzerland through 2046 for the right to own their bonds.

They are doing this for two reasons:

1) The ECB has announced it will be buying bonds for months to come.