Submitted by Ronan Manly, BullionStar.com

News has just emerged in the gold market that the giant Swiss precious metals refiner Argor-Heraeus has held discussions to be acquired, and that the likely outcome is an acquisition by a private equity group. This private equity group is believed to be London-based WRM CapInvest, part of Zurich headquartered WRM Capital. Other interested buyers are also believed to have examined a bid for Argor-Heraeus, including Japanese refining group Asahi and Swiss refining group MKS-PAMP, however, neither of these other two are thought to be in the running at this stage. Since this news is still developing, details of the discussions and the potential acquisition are still thin on the ground.

If Argor-Heraeus is acquired, it will mean that 3 of the 4 giant Swiss gold refineries will have been taken over by outside parties within less than a year and a half of each other.

In July 2015, Indian headquartered Rajesh Exports, the world’s largest gold jewellery fabricator, announced the agreed acquisition of the giant Swiss gold refinery Valcambi. See BullionStar article “Swiss Gold Refineries and the sale of Valcambi” for full details. In July 2016, Japanese precious metals refiner Tanaka Kikinzoku Kogyo K.K , part of the Tanaka Precious Metals group, announced the agreed acquisition of Metalor Technologies, another of the large Swiss gold refineries.

Articles by BullionStar

Hanging by a Thread: “Very skeptical” judge – a former FBI/SEC official, eyes London Gold and Silver Fix lawsuits

September 21, 2016By Allan Flynn, Guest Post at BullionStar.com

Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things.

Judge Valerie E. Caproni, former white-collar defense attorney, SEC Regional Director and controversial FBI General Counsel, presided over oral arguments for motions-to-dismiss totaling 9 hours on April 18 and 20.

Its “based entirely on statistics with no other,” the judge said, pouring cold water on plaintiff’s claims of bank collusion in gold benchmark rigging. Defense attorney scoffed as much at the silver hearing. “There is not a single fact… that shows an agreement between my client and the other alleged conspirators to fix the fix.”

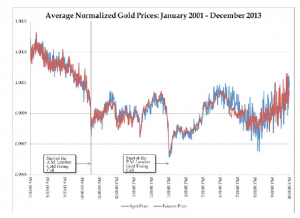

Seven banks are being sued in separate gold and silver class action lawsuits currently before the US. District Court, Southern District of New York. The plaintiffs: gold and silver bullion traders, and traders of various associated financial instruments, allege banks conspired in secret closed meetings, to rig the London PM Gold Fix, and Silver Fix benchmarks during the period from 2001 to 2013.

Central Banks & Governments and their gold coin holdings

June 13, 2016Within the world of central bank and government gold reserves, there is often an assumption that these gold holdings consist entirely of gold bullion bars. While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves.

These gold coin holdings are a legitimate part of gold reserves since under International Monetary Fund (IMF) definitions, “monetary gold consists of gold coins, ingots, and bars”. In central banking parlance, monetary gold is simply gold that is held by a central bank or government as a reserve asset. Other central bank reserve assets include foreign exchange holdings and holdings of IMF Special Drawing rights.

Elsewhere in IMF definitions, it is stated that “monetary gold is generally construed to be at least 995/1000 pure.” Many government and central bank gold coin holdings consist of previously circulated gold coinage. Since gold coins often had – and still have – a purity of less than 99.

Offshore Bullion Storage or 3 eggs?

June 2, 2016What does one hundred trillion dollars buy you?

How about a mansion in every country, an airplane at every airport and a private island in every ocean?

How about 3 eggs?

When Zimbabwe issued its infamous 100 000 000 000 000 dollar bill, it could buy 3 eggs on the day it was issued. A few days later, it could only buy one egg.

Hyperinflating Currencies

Unbacked fiat/paper/credit, and nowadays electronic currency, has a poor track record. After studying this list of 609 defunct currencies, out of which 153 died due to hyperinflation, it's obvious that every time fiat currencies are tried, they die through hyperinflation, war or political decrees.

Using the debt-based US Dollar as a store of value creates massive imbalances and misallocations globally. With an unprecedented debt bubble fuelling paper markets such as stocks and bonds, we stand on the cliff edge of a vertical drop.

Since the Nixon era, we have suffered under a fiat currency ponzi scheme wiping out most of the purchasing power of our currencies.

In MLM schemes, the idea is to recruit naive participants downstream to generate compensation for the recruiter.

This is exactly how the US Dollar and other fiat currencies work.

Early receivers of the MLM scheme such as the government, the banks and the central bank gain purchasing power whereas late receivers, such as us normal people, lose purchasing power.