(Disclosure: Some of the links below may be affiliate links) In 2020, inflation in Switzerland was negative, at -0.7%. It means that, on average, consumer prices have decreased in the year 2020. So, life has become cheaper in Switzerland. But is life in Switzerland really cheaper? And if so, is it cheaper for everybody? Today, I want to delve into inflation numbers for Switzerland and what they exactly mean. As we will see, inflation is not a perfect indicator of the cost of living in Switzerland. So, this article will talk in detail about inflation in Switzerland. Inflation in Switzerland Inflation in Switzerland is calculated by the Federal Statistical Office (FSO). Every month, they compute the Swiss Consumer Price Index (CPI). This index is a representation of the price of goods

Topics:

Mr. The Poor Swiss considers the following as important: Switzerland

This could be interesting, too:

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Dirk Niepelt writes “Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

(Disclosure: Some of the links below may be affiliate links)

In 2020, inflation in Switzerland was negative, at -0.7%. It means that, on average, consumer prices have decreased in the year 2020. So, life has become cheaper in Switzerland.

But is life in Switzerland really cheaper? And if so, is it cheaper for everybody? Today, I want to delve into inflation numbers for Switzerland and what they exactly mean. As we will see, inflation is not a perfect indicator of the cost of living in Switzerland.

So, this article will talk in detail about inflation in Switzerland.

Inflation in Switzerland

Inflation in Switzerland is calculated by the Federal Statistical Office (FSO). Every month, they compute the Swiss Consumer Price Index (CPI). This index is a representation of the price of goods for the average consumer in Switzerland. We will see in the next section exactly how this is computed.

What matters is the change from one month to the other. This is called monthly inflation. And at the end of the year, they also produce a report of the annual inflation.

Here are the annual results for the last three years:

- In 2018, inflation was 0.8%

- In 2019, inflation was 0.4%

- In 2020, inflation was -0.7%

These numbers are really low compared to other countries. A negative number means that prices are decreased. So, we should be paying less. We can correlate this with an increased purchasing power if the cost of living has been going down.

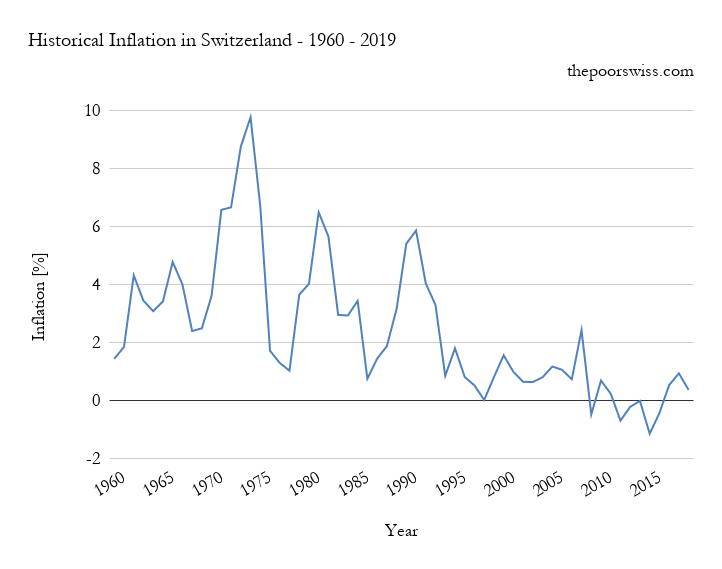

And here is the history of inflation in Switzerland:

We can see that since the end of the 1990s, inflation in Switzerland has been very reasonable. In the last 10 years, it has been mostly negative. In these last 30 years, inflation has been kept below 2%. Interestingly, a 2% annual inflation rate is the target of the Swiss National Bank. So, apparently, they did a good job there.

The SNB has two main instruments to work against inflation (or for inflation, if it is negative):

- Setting interest rate on the deposits held at the SNB by the other banks. This is why interest rates are currently negative.

- Purchasing foreign currencies to influence the strength of the CHF and influence export and import.

So, the reason we have very low-interest rates in Switzerland is that inflation has been too low in the years after 2010. In 2015, the SNB decided to lower its interest rate to -0.75%, among the lowest levels in the world. Since the SNB does not expect a large increase in inflation in the coming years, we can also expect interest rates to stay at their low level for a long time.

Swiss Consumer Price Index (CPI)

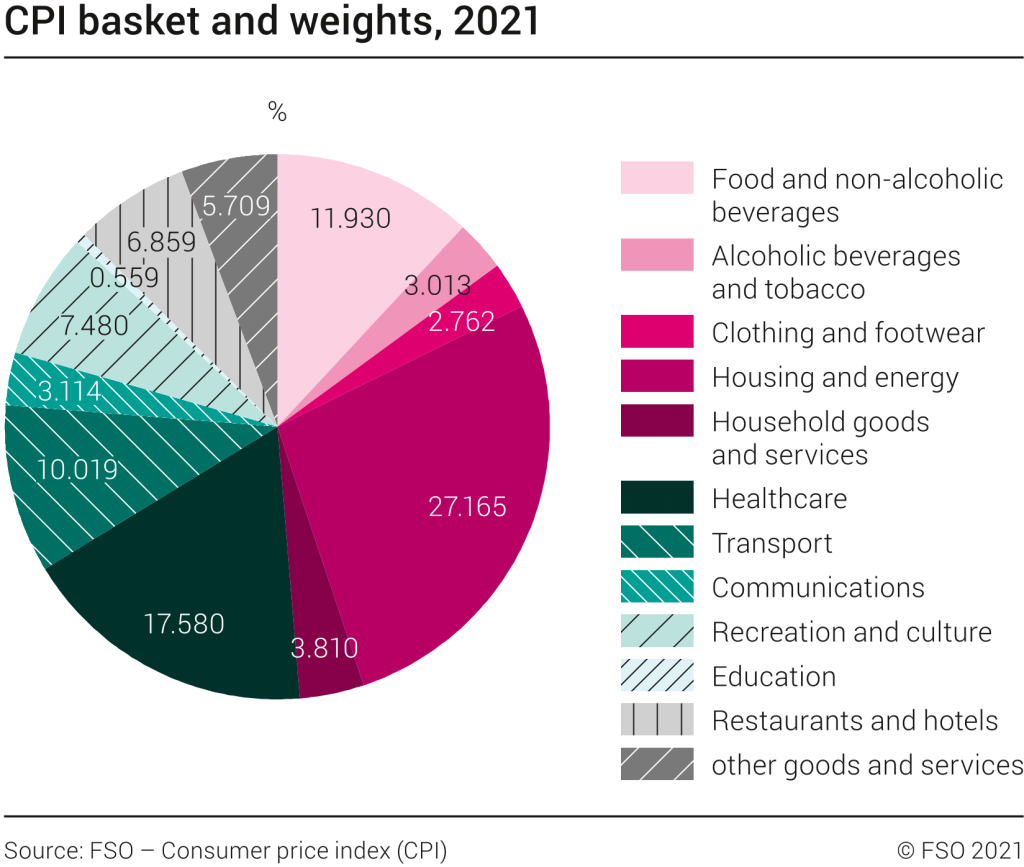

Inflation in Switzerland is computed with the Swiss Consumer Price Index (CPI). As mentioned before, the CPI is based on the average consumer. So, what does an average Swiss consumer consume? We have to observe in detail the composition of the CPI. Fortunately, all this is publicly shared and well-documented.

Here you can observe the composition of the basket for 2021:

For instance, we can see that the biggest part of the basket is the housing and energy category, followed by healthcare and food. The FSO will compute the average price for each of these categories and then use the weights of each category to compute the final inflation in Switzerland. This is done on a monthly basis for the CPI.

The composition of the basket can be updated when the consumption habits of the average household change.

If you want more information on this index, the website of the Federal Statistical Office has a wealth of information for you.

Problems with inflation in Switzerland

I think there are some issues with the measure of inflation in Switzerland. Or put another way, I think we have to be careful about the relation to inflation and the cost of living. I think inflation in Switzerland is properly measured, but we have to be careful with the conclusions we obtain from these measures.

For me, the biggest problem is the lack of the health insurance premium in the basket. Health insurance is a big item on a budget of Swiss households. For many families, it can become the number one category on a budget. We are going to talk more in detail about this issue in the next section.

Another issue is that it is an average over the entire population. For many people, it very poorly represents their cost of living. Of course, we cannot have an index for each person in Switzerland. That would be impossible. But we should have indices for different classes of households:

- Single persons

- Couples without kids

- Couples with kids

- Single parent with kids

This would greatly help people understand inflation and tie it to their cost of living in Switzerland. So, even if inflation in Switzerland is low for the average household, it may be higher for some types of households.

Another smaller issue is that it is averaged on the entire country. I would think we should have regional indices for each canton of the country. Unfortunately, there are currently only three cantons that provide regional inflation measures: Zurich, Basel, and Geneva. I do not think this is a huge issue since, generally, the difference in inflation between cantons is not huge. But once again, it would still help to have these measures.

Health Insurance and inflation

As mentioned before, inflation in Switzerland does not include health insurance premiums. Since health insurance is horribly expensive in Switzerland, it would really help if the CPI included health insurance premiums.

The rationale for not including it is that they consider this as a transfer. Indeed, you are paying money to the insurance that would then pay health care for you. This is the definition on which the CPI is based. But the inflation of health care costs is not directly related to the inflation of health insurance premiums. Also, given the large deductibles that most people have, health care costs also impact the expenses on top of health insurance premiums.

The issue is mostly that health insurance premiums are increasing in price very quickly. Since 1996, their prices have increased by 3.8% per year on average. Since 1996, the prices have increased a total of +This is quite insane. Switzerland has one of the most expensive health care systems in the world. For households in insurance, health insurance premiums account for 10% to 20% of their expenses. So, it is essential to take this into account in the inflation. Since

The Federal Statistic Office has recognized this problem. Since 2000 they have started publishing a second index, the Health Insurance Premium Index (HIPI). Unfortunately, it is not nearly as well documented as the CPI. Also, it is separated from the CPI. I would have liked an adjusted CPI index that included health insurance premiums. I have not been able to find historical values for this index. But it should follow health insurance premiums changes that I have mentioned before.

The lesson here is that we need to know that the measure of inflation in Switzerland does not include health insurance premiums. As such, inflation is likely higher for people than advertised by the CPI index. Inflation is not a perfect estimation of the cost of living in Switzerland.

Personal Inflation

Your personal inflation is the inflation based on your own basket of consumption. In most cases, this will be different from the average household basket. For instance, if you do not drink or smoke, you can remove an entire category from the basket. Or, if you are very frugal with your groceries, it may represent a much smaller portion of your budget.

If you want to know your personal inflation, you have two choices:

- You can look at all your expenses and see the trend over time. However, you need to have a good track record of your expenses with several years to see what happens to your expenses.

- You can use the Individual Inflation Calculator from the Federal Statistic Office.

For us, looking at our expenses is not a very good representation. We are still looking at improving our expenses. Also, it is changing with having a house now. So, our expenses are not stable enough to get a precise personal inflation rate. For instance, our current average is lower than in 2019 but significantly higher than in 2015.

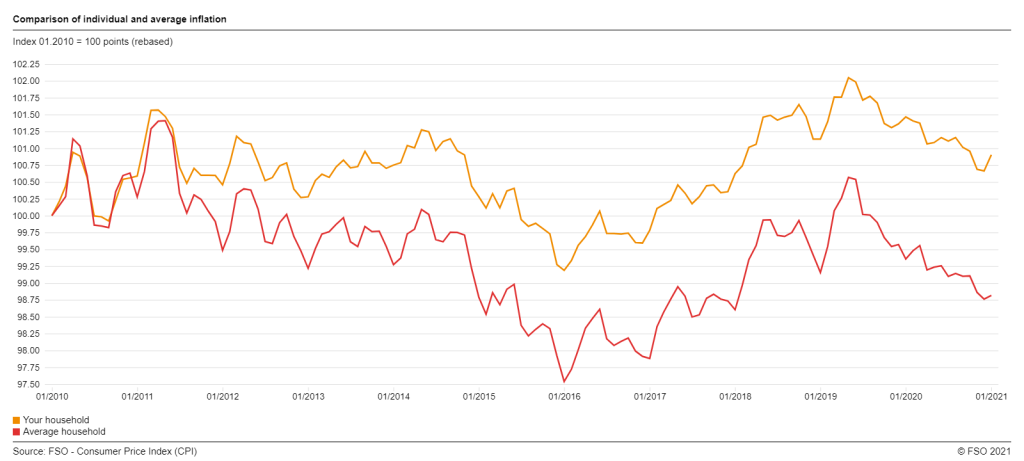

The calculator from the FSO is a great tool to look at inflation in Switzerland with your own basket of goods. If you know more or less what you are spending on each category of the basket, you can have a good representation of your personal inflation rate.

For instance, here are the results for our own household:

It is very interesting to see that our personal inflation is significantly higher than the inflation of the average household in Switzerland! Since 2010, the goods we are consuming have increased 1.2% while they have decreased 1.2% for the average household.

This is a great example! It really shows that the inflation of a household can be very different from the average household. Looking at the numbers, our high inflation seems related to several items:

- We spend little on communications which have decreased in price

- We spend little on transport which has also decreased in price

- We also spend little on recreation and culture

On the other hand, some things are reducing our inflation:

- We barely spend any money on alcohol and do not spend money on tobacco. These two items have become more expensive.

- We spend little on food, which has also become more expensive

- We spend little on health care, which has become very expensive

Overall, I find these results fascinating. It seems that we are an atypical household. By spending less on items that are becoming cheaper, the impact of inflation on our household is increasing.

Conclusion

Inflation in Switzerland in the last 20 years has been low. This means that the prices of goods have not increased much. This should be good for consumers.

On the other hand, it is important to note that some things are not included in the official inflation index. For instance, the very expensive health insurance premiums are not included.

Another thing that is included in the cost of living but not in inflation is taxes. For us, this is the biggest item in our budget. So, if they were to rise, it would greatly impact us.

Also, inflation is averaged over the entire Swiss population. And households are very different from one another. So, the official inflation in Switzerland needs to be taken with a grain of salt.

If you are interested in your own inflation, you should look at the individual calculator from the FSO. For us, our personal inflation is significantly higher than the average inflation in Switzerland.

If you are worried about inflation, I have an article about what to do about inflation.

What is your individual inflation rate? Are you worried about inflation in Switzerland?